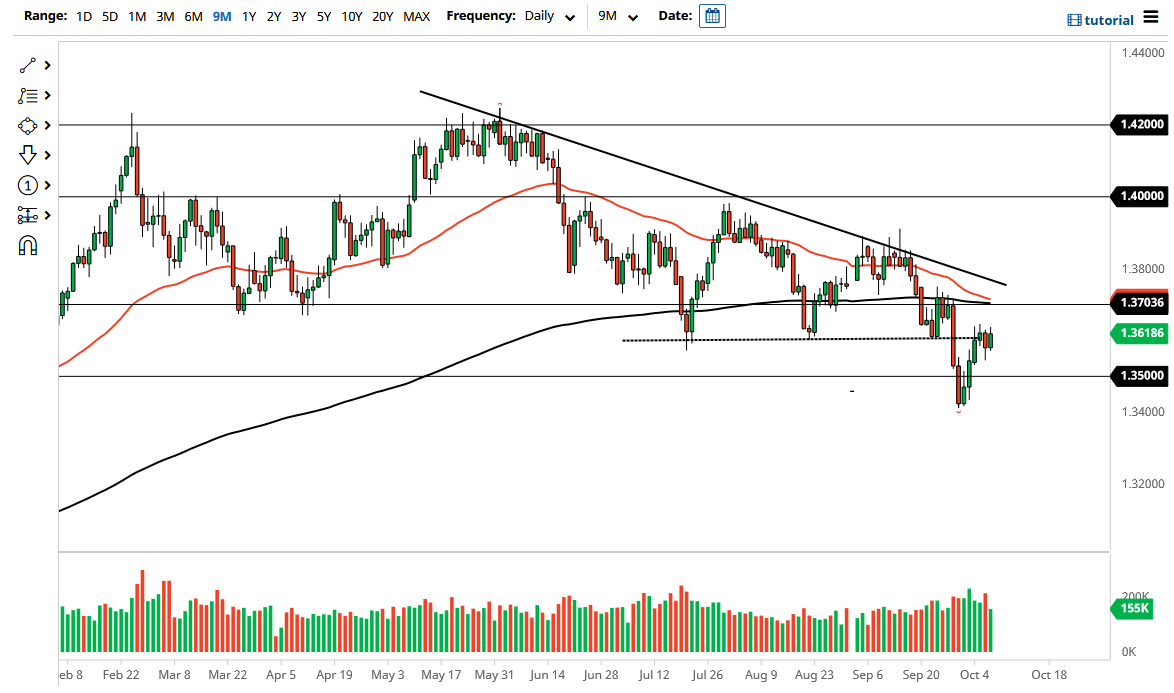

The British pound has rallied a bit during the course of the trading session on Thursday to go looking towards the bottom of the descending triangle that the market had previously been involved in. The 50 day EMA is starting to reach towards the 200 day EMA, forming the potential “death cross” that a lot of longer-term traders pay close attention to.

It is worth noting that the market has given up some of the gains towards the end of the day, and it is also worth noting that if we can break down below the candlestick from the Wednesday session, it could open up a move down to the 1.35 level, perhaps even lower than that. At that point in time, I would anticipate that we go looking towards 1.34 handle. A break below that level then opens up the possibility of a move much lower, perhaps reaching down towards the 1.3250 level, and then eventually the 1.30 handle.

I do believe that Friday could be crucial as to where we go next, mainly due to the fact that the Federal Reserve will have to take a look at the job situation and whether or not it is time to start tapering. The market has massive resistance at the 1.37 handle, so quite frankly if we do break out to the upside I am looking for some type of exhaustion in that area to start shorting yet again. The “death cross” has plenty of wait for longer-term traders, and of course have a massive downtrend line sitting just above there. In other words, I am selling this market either here, or I am selling it at higher levels. It is not until we break above the 1.38 level that I would even remotely consider buying this market.

The one thing that could get me to change my attitude is if the jobs number is absolutely horrible. That being said, there have been rumblings coming out of the Bank of England involving the possibility of negative interest rates, which would obviously make the British pound a lot less attractive. Central banks around the world have been racing to the bottom, so this next stage of the currency war should be rather interesting. Looking at this chart, I think we have further to go to the downside.