The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a some strong valid long-term trends in the market right now, so it is a good time to be trading to take advantage of that.

Big Picture 3rd October 2021

Last week’s Forex market mostly moved in line with prevailing trends. The Australian and US dollars were strong, while the New Zealand dollar and euro were notably weak. Global stock markets moved firmly lower, with the S&P 500 Index having its worst monthly performance since March 2020.

I wrote in my previous piece last week that the best trades were likely to be short in silver and the GBP against the USD once new low daily closing prices had been made below $22.25 and $1.3600, respectively. This produced a tiny loss in GBP/USD and a loss of a little less than 4% in silver, giving an averaged loss of approximately 2%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were a worsening global energy crisis, politicking in the US over the passage of huge federal spending (in the trillions) on infrastructure, and the US Federal Reserve’s continued insistence that the recent rise in inflation is transitory. There were almost no significant economic data releases made during the week. Within these headlines, the failure of energy supplies to keep up with global demand and resulting supply chain disruption issues are probably most significant for traders, as this clearly caused a rise over the week in the price of WTI Crude Oil to the highest weekly close in almost 7 years above $75 per barrel. Natural gas briefly traded above $6, a price level which had not been seen for even longer than that. Stock markets were weaker almost everywhere over the week, as the sentiment grows that the US market is due for a major correction in the face of worsening global growth prospects.

This week’s schedule will be dominated by US non-farm payrolls data, the monthly policy release from the Reserve Bank of New Zealand, and the Reserve Bank of Australia’s rate statement.

Last week saw the global number of confirmed new coronavirus cases fall for the sixth consecutive week after previously rising for more than two months, with deaths lower for the fifth consecutive week. Approximately 45.5% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases right now are happening in Barbados, Belarus, Belize, Bulgaria, Croatia, Egypt, Estonia, Latvia, Lithuania, Moldova, Romania, Russia, Singapore, Slovakia, and the Ukraine.

Technical Analysis

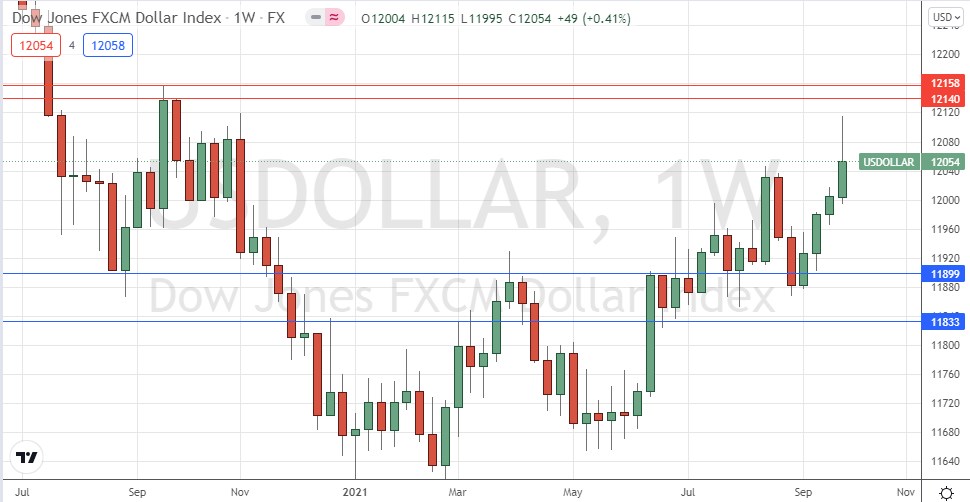

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed another bullish candlestick last week after having earlier rejected the zone of support which I had identified between 11899 and 11833. The price is above the levels from 3 and 6 months ago, which shows that the long-term bullish trend in the greenback is still valid. However, the candlestick closed within the bottom half of its range after falling for two days, so the short-term momentum is against the USD right now. This suggests that trades in the USD look better on the long rather than short side right now, so the best strategy in the Forex market over the coming week will probably be to look for long trades in US dollar currency pairs but only once the short-term momentum turns from bearish to bullish.

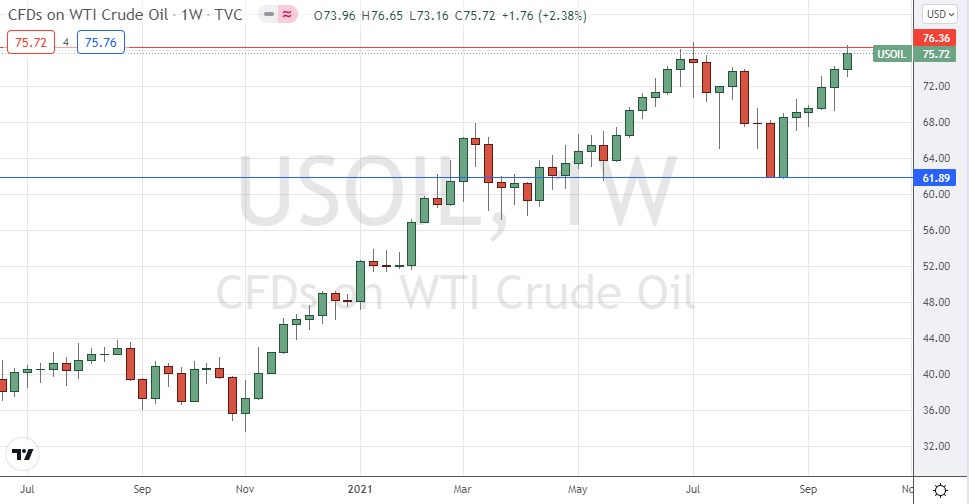

WTI Crude Oil

WTI Crude Oil closed Friday at a new 7-year high weekly closing price. This is a bullish sign and many trend-following hedge funds will be buying more WTI Crude Oil futures on Monday. However, bulls should be warned that the multi-month price action remains rectangular shaped, as can be seen by the price chart below, with the $76.36 level above the current price quite likely to act as resistance. Nevertheless, the price is likely to rise over the very short term and could rise by much more once it gets established above $76.36.

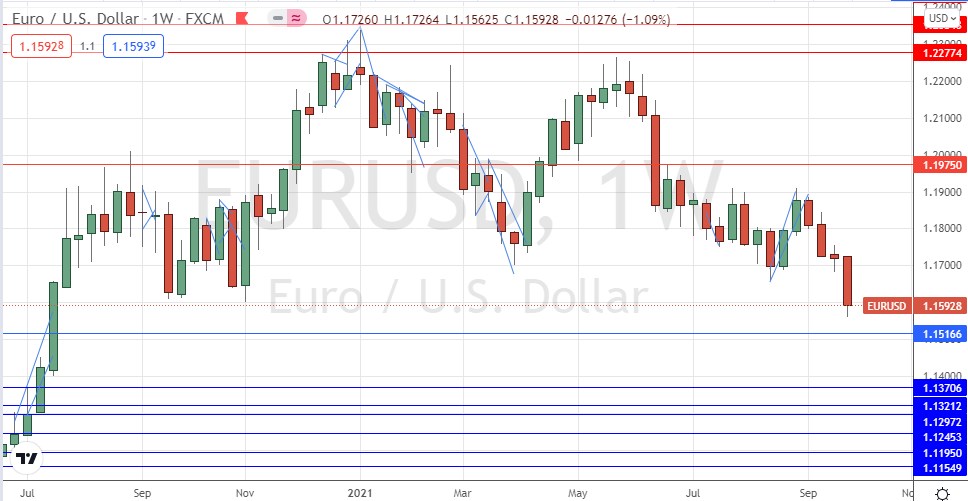

EUR/USD

The EUR/USD currency pair broke to a new 14-month low price, closing near the bottom of its weekly range, although Friday did produce an up day. The euro has the steadiest long-term weakness of any major currency. These are bearish signs. It is likely that the price will continue to move lower over the coming days, although the medium-term downside may be limited by the big psychological round number below at 1.1500, which is confluent with a long-term pivotal horizontal level at 1.1517 which may halt the drop. There is an attractive short-term short trading opportunity here.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short EUR/USD and long WTI Crude Oil in US Dollar terms, especially following a daily (New York) close above $76.36.