It was a sharp bearish trading week for the EUR/USD, which collapsed to the 1.1563 support level, a 14-month low, and closed trading around the 1.1592 level.

Inflation in the Eurozone rose sharply in September and is expected to extend upward during the fourth quarter.

However, the euro exchange rates don't look likely to match that trajectory in early 2022, and the rate of price appreciation should start to decline, according to economists. Eurozone inflation reached its highest level in a decade in September, rising 3.4% year-on-year from 3.0% in August, topping the 3.3% consensus forecast. Commenting on the results, “Eurozone inflation is still advancing,” says Klaus Veesten, chief Eurozone economist at the Pantheon Macroeconomics, adding that core and factor inflation will remain elevated in the fourth quarter.

Eurostat says that the highest contribution to annual inflation in the Eurozone came from energy (+1.44 percentage points), followed by non-energy industrial goods (+0.65 points) and food, alcohol, tobacco and services (both +0.43 points). "Inflation concerns arising from food and energy prices remain a concern in Europe," said Selina Laing, head of research and strategy at OCBC.

Recently, the European Central Bank, in September, raised its long-term inflation forecast to 2.2% for 2021, 1.7% for 2022 and 1.5% for 2023. The ECB's core inflation rate is now expected to be 1.3% for 2021, 1.4% for 2022 and 1.5 % for 2023. As evidenced by the forecast above, the European Central Bank estimates that the sudden rise in inflation will be temporary and that it will fall below its 2.0% target by 2022.

Thus, the euro exchange rates will not be affected much by inflation data until it becomes clear that inflation in the Eurozone moves to 2.0% and above during the period 2022-2023.

Analysts are of the view that the contribution of energy prices to the Eurozone inflation mix means that the Eurozone inflation rate is unlikely to materially affect the ECB's inflation outlook, and thus policy.

The latest Eurozone inflation data come amid mounting investor concerns that global inflation will remain elevated for longer than expected as global supply chain issues remain stubbornly disrupted. The surge in European gas prices is of particular concern due to the continued decline in Russian imports and massive bids with Asia for any seaborne natural gas supplies.

Several central banks have recently come out to warn that the longer the supply-side inflationary pressures seen over recent weeks persist, the greater the chance that they will begin to affect inflation elsewhere. For example, if consumers believe that inflation will continue to rise, they will begin to demand higher wages, and businessmen will respond by raising their own prices.

However, Macroeconomics Pantheon still expects Eurozone inflation to decline in the first quarter of 2022. They expect ECB policy to remain accommodative, as although the Emergency Quantitative Easing Program (PEPP) will stop in March, the longer-running APP will be increased and up and running at €40 billion per month.

The big picture, then, is that the current bout of inflation is unlikely to change the euro's long-term inflation problem.

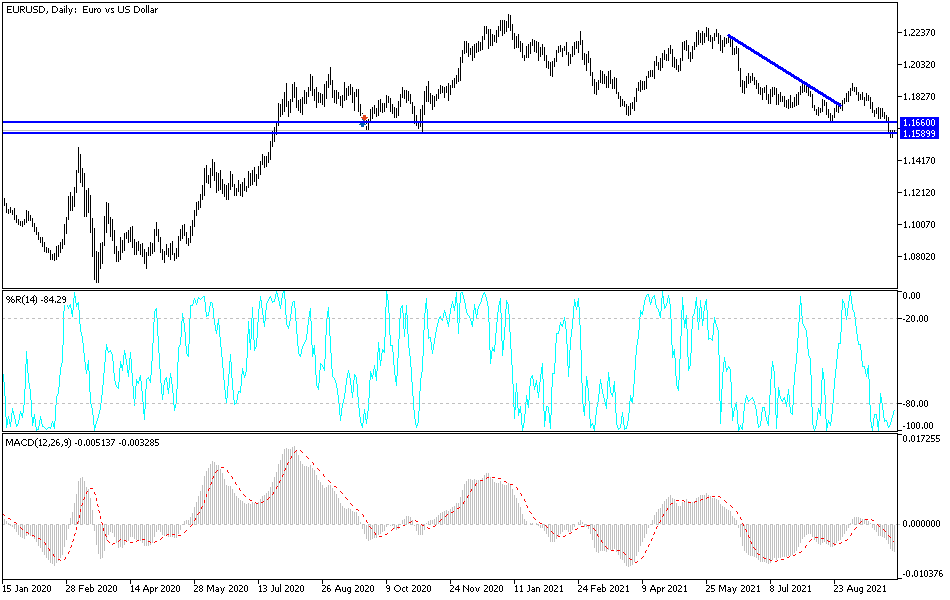

Technical analysis of the pair

So far, the general trend of the EUR/USD pair is bearish, and stability below the support level 1.1600 supports the strength and control of the bears, and at the same time moves technical indicators towards strong oversold levels. Currently, the closest support levels for the pair are currently 1.1565, 1.1480 and 1.1400. The currency pair, with its sharp losses recently, will be awaiting the important US jobs numbers.

On the upside, the psychological resistance at 1.2000 will remain crucial for a complete change of the general trend to the upside, and for that to happen, the resistance levels at 1.1660 and 1.1775 must be breached. The analysis is as shown on the daily chart below.

The rate of change in Spanish jobs and the Sentix indicator of economic sentiment in the Eurozone will be released, followed by US factory orders.