Despite the US oldlar's gains after the high US inflation figures and the FOMC minutes, the EUR/USD couldn't get past the 1.1601 level on Thursday. The currency pair collapsed to the 1.1524 support level, its lowest in 15 months. The euro is still under pressure from the divergent economic performance and the future of monetary policy tightening between the Eurozone and the United States of America.

Scandinavian bank and investment bank Danske have lowered expectations for the EUR/USD. “The hawkish stance from the Fed continues to support our expectations for a stronger dollar,” says Jens Nærvig Pedersen, chief analyst at Danske Bank.

In its latest market guide update, Danske Bank explained that a further decline in the EUR/USD exchange rate is largely linked to expectations of a stronger dollar, and that only a significant recovery in global economic growth would provide a rally in the euro. The call comes as EUR/USD trends drop and threatens to move towards a new one-year low of 1.1557.

The shift in Danske Bank's forecast for the EUR/USD comes in response to slowing global economic growth trends. Although the Eurozone and US economies continued to grow, easy gains were made. The sluggish growth environment - which has roots in China - is expected to be one that favors further advances in the dollar.

Despite the slowdown, Danske believes that the US Federal Reserve will begin to scale back its asset purchase program in the last quarter of 2021. “This will continue to shift market attention towards the US dollar on the issue of monetary divergence against the EU," Pedersen says. “Reflecting market themes increasingly turning to dollar support as global liquidity conditions tighten, PMIs are poised to move lower and central banks face rising inflation fears, we are lowering our position for the EUR/USD pair."

Accordingly, Danske Bank lowered its forecast for EUR/USD to 1.10 in twelve months (from 1.13).

The upside risks to this view include a return of the EUR/USD back above 1.20 should global inflation pressures abate. Another risk to their view is the pivot from the Fed as they back off their intention to end quantitative easing and raise interest rates, perhaps in response to a slower-than-expected US recovery.

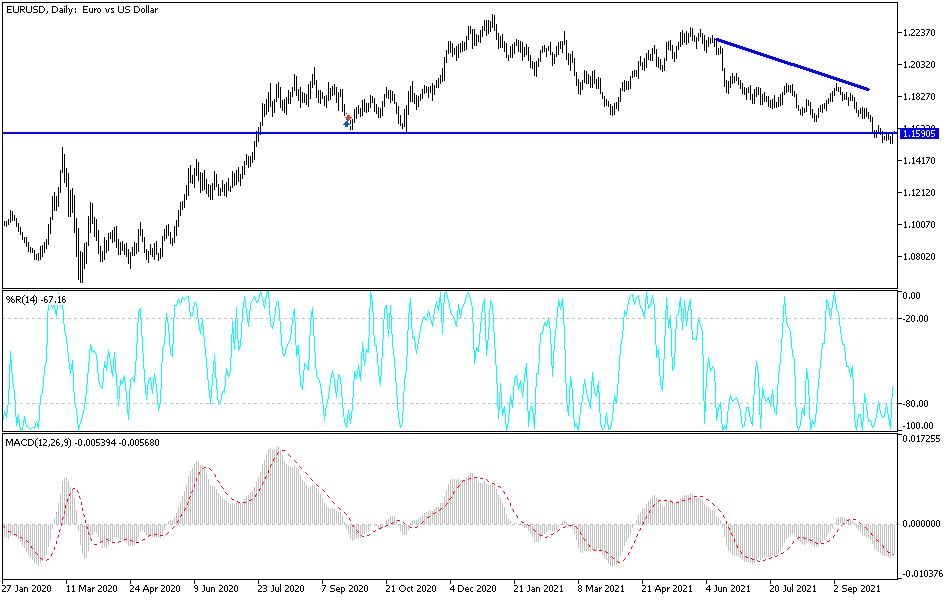

Technical analysis of the pair

The recent rebound attempts of the EUR/USD did not get it out of its current bearish channel, which it won't be able to do without moving above the 1.2000 psychological resistance. The current move towards the 1.15 support is moving the technical indicators towards strong oversold levels, and for the above mentioned factors, the currency pair will remain under bearish pressure until something changes. Today, the number of US weekly jobless claims will be announced, and the Producer Price Index reading is an element of the country's inflation figures.