After the US job numbers were announced on Friday, the EUR/USD rebounded higher, reaching the resistance level of 1.1586 and closing stable around 1.1573. The weekly closing was bearish near the 14-month low. According to official data, US employment rose much less than expected in September, according to a closely watched report released by the Labor Department on Friday.

The Labor Department said that non-farm payrolls increased by 194,000 jobs in September after rising by an upwardly revised 366,000 jobs in August. Economists had expected US employment to jump by 500,000 jobs, compared to the 235,000 job addition originally reported for the previous month. Much weaker-than-expected job growth was partly due to the seasonally adjusted decline in employment in education, which fell by 180,000 jobs as back-to-school employment was lower than usual.

The report also showed employment in the leisure and hospitality sector increased by a relatively modest 74,000 jobs, after rising earlier in the year amid the reopening of the economy. At the same time, strong job growth was observed in the professional and commercial services, retail trade, and transportation and warehousing sectors. Despite much weaker-than-expected job growth, the nation's unemployment rate fell to 4.8% in September from 5.2% in August. The unemployment rate was expected to fall to 5.1%.

From the EU, the seasonally adjusted German Trade Balance for August missed expectations at €15.8 billion with a record of €13 billion. Prior to that, the country's seasonally adjusted industrial production for August also came in below expectations (month-on-month) at -0.4% with a -4% change, and German factory orders disappointed. On the other hand, EU retail sales for August came out against expectations on (annual) and (monthly) basis.

The EUR/USD exchange rate is expected to outperform in 2022 as the Eurozone begins to experience above-trend economic growth and the counter-cyclical dollar declines again, according to a Swiss private bank. "Global growth above trend and structurally low inflation should give the euro a comparative advantage," says Claudio Wewell, Forex analyst at JS Safra Sarasin. Wewell describes the euro's continued loss of value against the dollar - a trend that began in May - as a bounce that has now been crossed.

“The EUR/USD rebound appears to be exaggerated and we expect the currency to recover modestly in 2022,” Wewell said.

The Eurozone economy is expected to recover by the bank amid the release of pent-up consumer demand and payments from the European Recovery Fund. Indeed, J. Safra Sarasin expects the Eurozone to enjoy a period of above-trend growth, which is likely to push the euro cyclically higher. Low structural inflation is also expected to act as an additional tailwind in the medium term.

Global inflation is rising amid ongoing supply bottlenecks and energy shortages, as moves in the Forex market suggest that the dollar is benefiting in this environment while the euro in particular is proving weak. The dollar has gained value in recent months thanks in part to a rebound in global economic growth amid headwinds brought about by the delta variant and rising inflation. However, the forces supporting the dollar are expected to ease towards the end of the year. Wewell added: “While the current strength may persist for a while, continued strong global growth would weigh on the counter-cyclical dollar. Moreover, continued large-scale deficit-financed government spending, combined with a widening trade deficit, would keep the US twin deficit high and weaken the US dollar in the long run.”

J. Safra Sarasin Bank has a year-end target forecast of 1.20 per euro, with a rate of 1.21 at the end of the first quarter of 2022, a rate of 1.21 by the middle of the year and a rate of 1.22 by the end of 2022.

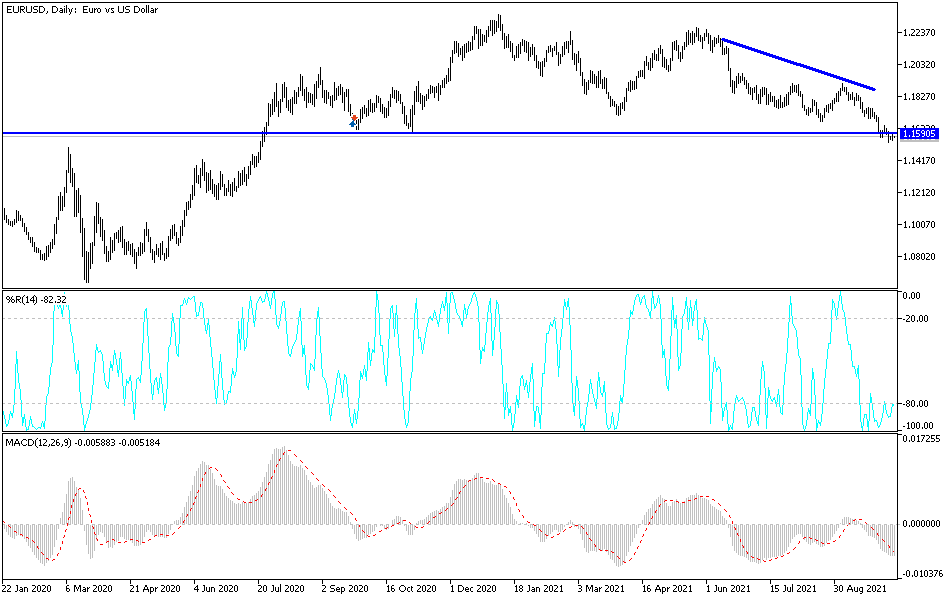

Technical analysis of the pair

In the near term, and according to the performance of the hourly chart, it appears that the EUR/USD is trading within an ascending channel formation. The pair recently rose near the overbought levels of the 14-hour RSI. This indicates a significant short-term bullish momentum in market sentiment. Accordingly, the bulls will look to extend the current gains towards 1.1590 or higher to 1.1605. On the other hand, the bears will look to pounce on a potential pullback at around 1.1554 or lower at 1.1539.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. It recently declined near oversold levels on the 14-day RSI. This indicates a strong long-term bearish momentum in the market sentiment. Therefore, the bulls will target potential rebound profits around 1.1632 or higher at 1.1698. On the other hand, the bears will look to extend declines towards 1.1507 or lower to 1.1440.