The EUR/USD has been hovering around the 1.1600 resistance the last 4 sessions in an attempt to correct after its recent sharp losses. Its rebound gains reached the 1.1655 resistance as of this writing, waiting for strong catalysts to complete the rebound higher. There are no major reports due from the Eurozone today, as major releases are expected at the end of the week. The PMI readings are due, and there is another round of declines in the manufacturing and services sectors in Germany and France.

Also, supply chain issues are likely to have an impact on the latest set of leading indicators, and are likely to affect new orders and production activity for the current month. Weaker than expected results could mean a decline in the single European currency, and traders may be keen to price in their expectations ahead of the actual release.

Meanwhile, the US dollar remains supported as the CPI and retail sales data appear to still support the tapering of the US Fed's purchases during the month of November. Also, China printed pessimistic GDP data, and this may keep investors in a risk-averse mood and prefer the US dollar as a safe haven. Today, the US housing market figures for building permits and housing starts will be announced.

Investment bank Danske has lowered its forecast for the EUR/USD. “The hawkish stance from the Fed continues to support our expectations for a stronger dollar,” says Jens Nærvig Pedersen, chief analyst at Danske Bank. In its latest market guide update, Danske Bank explained that a further decline in the EUR/USD exchange rate is largely linked to expectations of a stronger dollar, and that only a significant recovery in global economic growth would provide an appreciation for the euro.

The call comes as EUR/USD trends drop and threatens to print a new one-year low at 1.1557.

The shift in Danske Bank's forecast comes in response to slowing global economic growth trends. Although the Eurozone and US economies continued to grow, easy gains were made. The sluggish growth environment - which has roots in China - is expected to be one that favors further advances in the dollar.

Despite the slowdown, Danske believes that the US Federal Reserve will begin to scale back its asset purchase program in the last quarter of 2021.

Accordingly, Pedersen says, "This will continue to divert market attention towards the US dollar on the issue of monetary divergence against the European Union." He adds: “Reflecting general market topics increasingly turning to dollar support as global liquidity conditions tighten, PMIs prepare to move lower and central banks face rising inflation fears, we are lowering our position for the EUR/USD pair.”

Accordingly, Danske Bank lowered its forecast for EUR/USD to 1.10 in twelve months (from 1.13). The upside risks to this view include a return of the EUR/USD back above 1.20 should global inflation pressures abate. Another risk to their view is the pivot from the Fed as they back off their intention to end quantitative easing and raise interest rates, perhaps in response to a slower-than-expected US recovery.

Additional potential support for the euro could come in the form of a renewed boom in global industry "which could support a new move higher for global contracting assets".

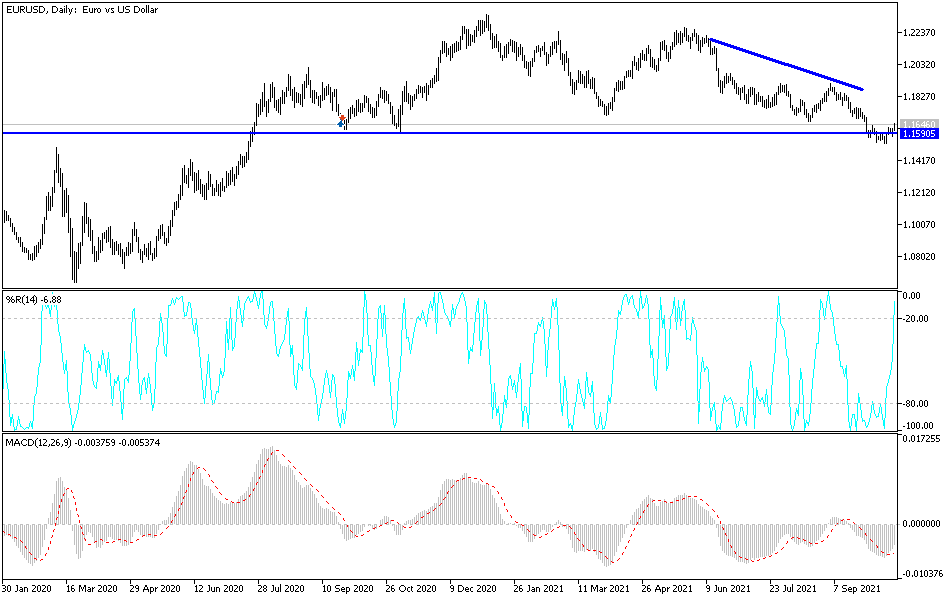

Technical analysis of the pair

The EUR/USD may sell off in the short term, as the price failed in the last two attempts to break above the 1.1620 mark, creating a double top pattern on the hourly time frame. A break below the support around 1.1580 could trigger a decline that is as high as the chart formation. This may drop the EURUSD to the 1.1540 support or lower.

However, the 100 SMA remains above the 200 SMA to indicate that the trend is beginning to turn higher or that the support is more likely to continue than to be broken. These moving averages also coincide with the neckline support to add to their strength as a floor. The stochastic has some room to move lower before reaching an oversold area to indicate exhaustion among the sellers. A return to the upside means buyers are back and may allow the uptrend to resume.

The RSI has more room to move down, so the price can follow suit while there is downward pressure.