The EUR/USD is still trying to rebound higher, but it is dominated by a cautious correction, as the euro is still suffering from weak investor sentiment. The US dollar is enjoying strength near the 1.1524 Support, due to the tightening of the Federal Reserve's policy and the improvement in economic performance, in complete contrast to what is happening in the Eurozone.

Investors are currently busy reviewing the latest report cards from companies as they try to get a clearer view of the economic path forward amid rising inflation and the ongoing threat of COVID-19. One of the main concerns remains supply chain disruptions and rising material costs leading to lower profits for many companies. Higher costs for businesses could mean higher prices for consumers, which could threaten spending that underpins the economic recovery. Commenting on this, says Greg Psock, CEO of AXS Investments, it appears that investors are taking the impact of high inflation on companies at a rapid pace.

"Without major surprises on the downside, or something very big, the bulls are outpacing the bears," he added.

The rising inflation also put more focus on the Fed's policy and plans to start reducing bond purchases which helped keep interest rates low. For most of the year, the Fed maintained that inflation was likely to be temporary and linked to economic recovery, but it became more concerned about persistently high inflation.

Eurozone inflation rose as initially expected in September, final data from Eurostat revealed. Inflation rose to 3.4 percent in September from 3.0 percent in August. In the same period last year, prices fell by 0.3%. The price matched preliminary estimates published on October 1. This was the highest rate since September 2008. Core inflation, which excludes energy, food, alcohol and tobacco, rose to 1.9 percent, as initially estimated, from 1.6 percent in the previous month.

On a monthly basis, the harmonized index of consumer prices rose 0.5 percent, in line with flash estimates. Annual inflation was largely driven by the sharp increase in energy prices of 17.6 percent. Among other components, food, alcohol and tobacco prices rose 2.0% and non-energy industrial goods prices rose 2.1%. Prices for services rose 1.7 percent.

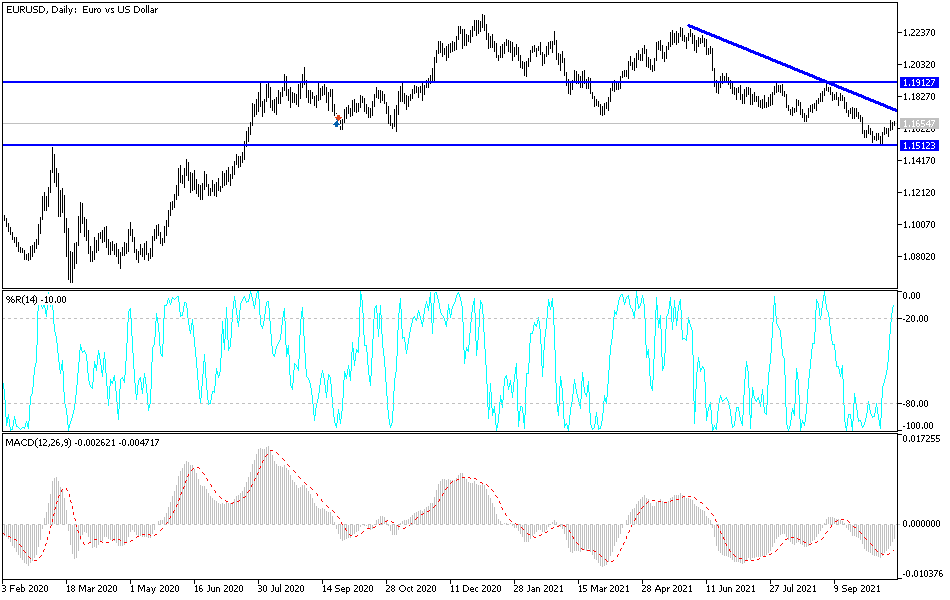

Technical analysis of the pair

On the daily chart, the EUR/USD is still at the beginning of forming an ascending channel, and it needs more momentum. In order for the general trend to turn bullish, the pair must break through the 1.2000 psychological resistance. Otherwise, the stronger bearish trend will remain. The pair is still stable near its lowest level in four years. Moving below the 1.1600 support gives the bears the opportunity to move strongly again, and the closest current support levels are 1.1620, 1.1545 and 1.1480.

Consumer confidence numbers will be announced in the Eurozone. From the US, US jobless claims will be released, as well as the Philadelphia Industrial Index, the existing home sales, and statements by some US monetary policy officials.