Bullish View

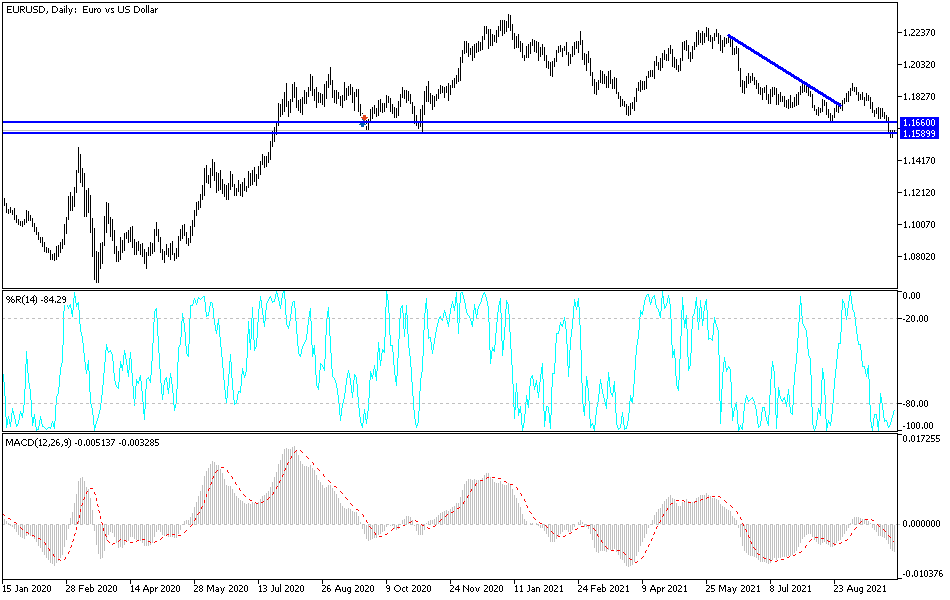

Buy the EUR/USD and set a take-profit at 1.1663.

Add a stop-loss at 1.1562.

Timeline: 1-3 days.

Bearish View

Sell the EUR/USD and set a take-profit at 1.1550.

Add a stop-loss at 1.1635.

The EUR/USD pair was little changed in early trading as investors continued to reflect on the recent Eurozone consumer inflation data. The pair is trading at 1.1593, which was slightly above last week’s low of 1.1562.

Eurozone Inflation Rising

Eurostat, the official statistics agency of the European Union, published the preliminary inflation numbers on Friday. The data showed that consumer prices in the bloc continued rising in September. In total, the headline Consumer Price Index (CPI) rose by 3.4% in September, the highest level in 13 years. Core CPI, which excludes the volatile food and energy products, rose by 1.6% in September.

Shortly afterwards, the US Department of Commerce published the latest purchasers consumption expenditure (PCE) rose by 0.4% in August, the sixth straight month of increase. On a YoY basis, the PCE, which is the Fed’s favourite inflation indicator, rose to 4.3% in August. This was the highest reading since 1991.

Additional data showed that America’s personal income rose by 0.2% in August after rising by 1.1% in the previous month. At the same time, personal spending rose by 0.8%, which was higher than the median estimate of 0.6%.

There will be no major economic data scheduled from both the EU and the US today. Therefore, investors will continue paying close attention to the latest political situation in the US. For one, the House of Representatives failed to pass the landmark $1.2 trillion infrastructure package.

There is a high probability that the Senate will fail to pass the debt ceiling bill. Therefore, this will increase the possibility that rating agencies will slash the country’s credit rating, which will hike the cost of borrowing.

The biggest catalyst of the EUR/USD will be the US non-farm payroll numbers that will come out on Friday this week.

EUR/USD Forecast

The four-hour chart shows that the EUR/USD pair has been in a strong bearish trend in the past few weeks. The pair has managed to drop from a high of 1.1900 to a low of 1.1562. That was a 2.92% decline. It managed to move below the key support at 1.1663 last week. This was the lowest level in August. Also, it fell below the 25-day and 15-day moving averages.

Therefore, after the strong bearish trend experienced last week, there is a possibility that a relief rally will happen this week as bulls target the key resistance at 1.1663.