Bearish View

Sell the EUR/USD and set a take-profit at 1.1500.

Add a stop-loss at 1.1620.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.1600 and a take-profit at 1.1700.

Add a stop-loss at 1.1550.

The EUR/USD was little changed on Monday morning as investors reflected on the relatively mixed US non-farm payrolls data and the upcoming inflation numbers. The pair is trading at 1.1575, which is slightly above last week’s low of 1.1530.

US Employment and Inflation Data in Focus

The Bureau of Labor Statistics (BLS) published mixed jobs numbers on Friday. The data revealed that the country added just 194,000 jobs in October after it added 366k jobs in the previous month. This data was significantly lower than the median estimate of 500k. A previous reading by ADP had pegged the private payrolls at about 543k.

On the positive side, the country’s unemployment rate declined to 4.8%, meaning that the country is experiencing full employment even as millions remain out of the labor force. Wages also rose by 4.6% while the participation rate remained unchanged at 61.4%.

The next major catalyst for the pair will come on Wednesday when the US will publish the latest Consumer Price Index (CPI) data. Economists polled by Reuters expect the data to show that the headline CPI remained unchanged at 5.3% in September while the core CPI rose by 4.0%.

Therefore, these numbers could signal that the US is moving to a period of stagflation, where high inflation coincides with a period of high unemployment rate. Stagflation is usually considered to be one of the worst economic conditions in an economy.

The EUR/USD pair is also reacting to the relatively limited risks in the economy after Congress passed a bill to expand the debt ceiling for three months. Without the deal, the country would have defaulted on its obligations in the coming few weeks. The next important mover for the pair will be the earnings season, which starts this week.

EUR/USD Forecast

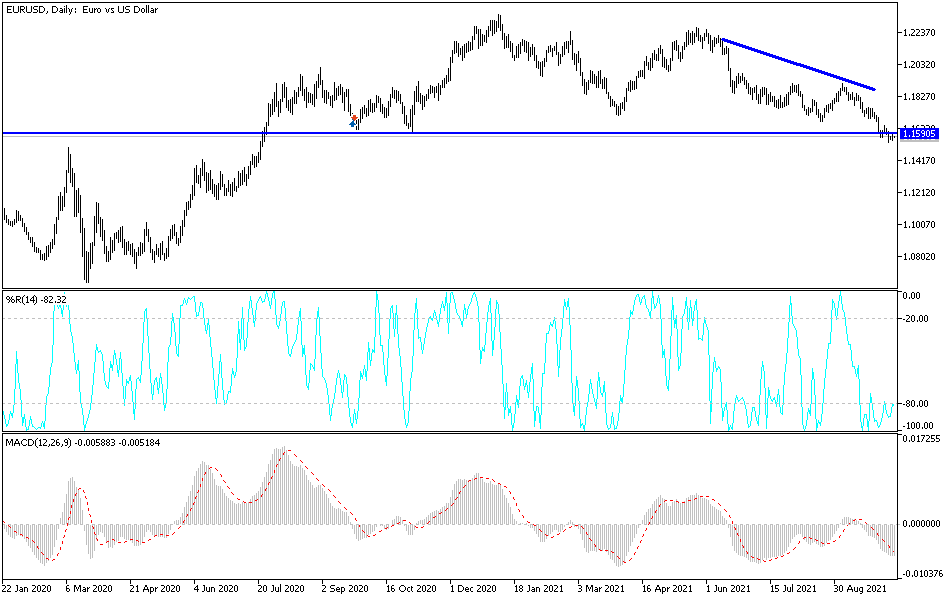

The four-hour chart shows that the EUR/USD pair has been in a tight range recently. The pair is trading at 1.1575, which is only a few pips above its lowest level last week. The pair has also formed a bearish flag pattern that is shown in green. In price action, a bearish flag pattern is usually a bearish signal. The pair’s bearish trend is also being supported by the 25-day and 50-day moving averages.

Therefore, the pair will likely break out lower in the near term. This will see it decline to the key support at 1.1500.