Last Thursday’s EUR/USD signal was not triggered as none of the key support or resistance levels I identified were reached that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today only.

Short Trade Ideas

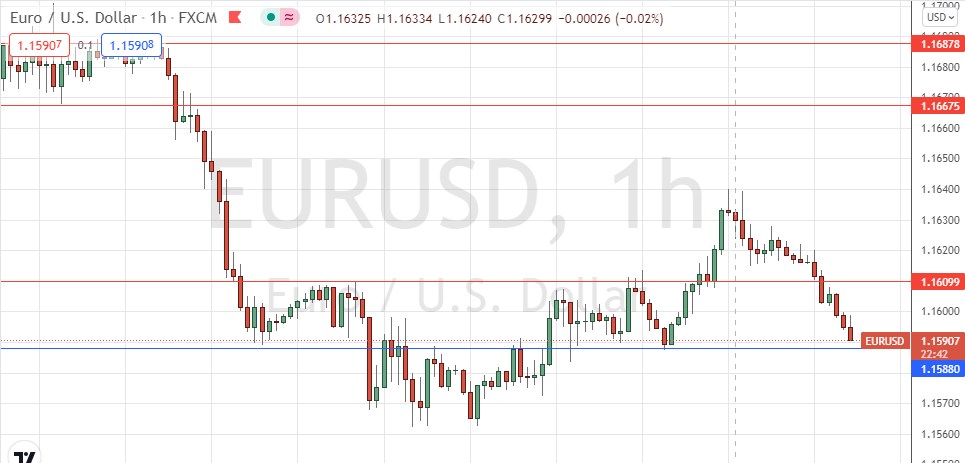

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1610 or 1.1688.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1588 or 1.1517.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that as the previous day had covered nearly twice the average true range of the past 15 days, we were likely to see a further meaningful downwards price movement over the day, meaning there could be a good short trade opportunity here, as the price today had still not broken below yesterday’s low.

This was a very good call as the price did fall the next day. However, after that, the price turned around and made a firm bullish retracement, which lasted for two days, calling the momentum of the downwards break into question.

The price began to fall again yesterday, and at the time of writing we are again approaching recent lows and back below the resistance level at 1.1610.

I see the key thing to watch for today here in EUR/USD as whether the price can make a daily (New York) close below last week’s closing low at 1.1574. If so, that could be a great sign for trend traders (especially position traders) to go short. The USD has long-term strength, and the Euro is relatively weak, and this supports the bearish case.

The problem for bears is that there is a new support level now at 1.1588 which may halt the slide or even produce a bullish reversal.

I think the best approach today will be to see how the price reacts at 1.1588 and trade accordingly.

I will take a bearish bias if we get a New York daily close below 1.1574.

Concerning the USD, there will be a release of ISM Services PMI data at 3pm London time. There is nothing of high importance due today regarding the EUR.