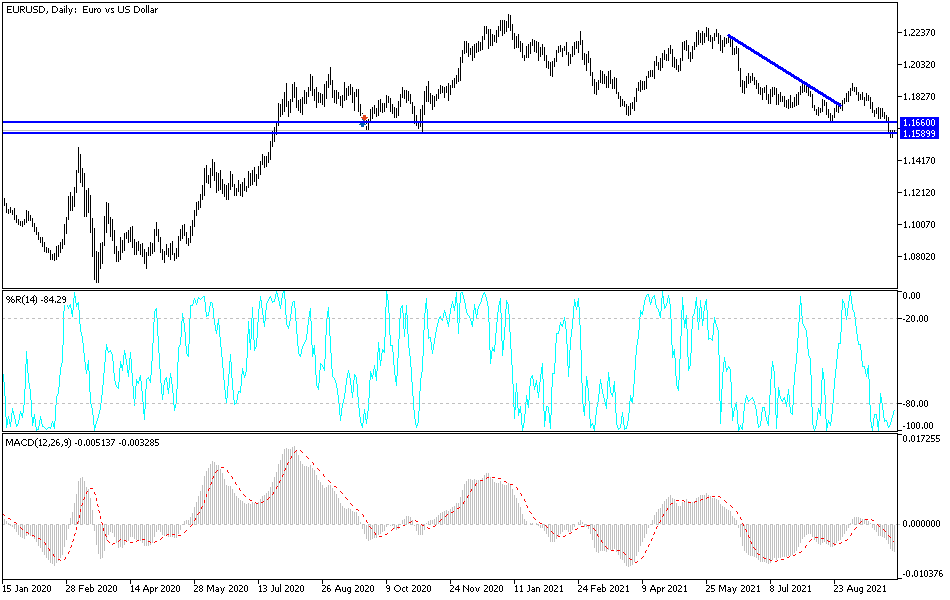

The euro recovered a bit on Friday, but after we have seen this massive amount of selling pressure, it is very unlikely that it is the beginning of a change in attitude. The market is likely to hear a lot of noise right around the 1.16 level, but even if we break above there, it is likely that we will see even more resistance beyond that near the 1.17 level. This is a market that will be noisy to say the least, and probably held hostage by the bond market over the next several sessions. With yields surging in the United States, and the European Union struggling to find power, it is probably not a real stretch to think that the euro could fall further.

If we were to break down below the bottom of both Thursday and Friday, the market is likely to go looking towards the 1.15 level. At that point, it is very likely that we would continue to see a bit of noise right around the 1.15 level, if for no other reason than we have a certain amount of psychology involved in that region. If we were to break down below the 1.15 level, it is very likely that the market would fall apart completely at that point. That would almost certainly have something to do with economic turmoil and fear, so I think we probably have quite a bit of volatility ahead regardless. We will get some type of huge, short squeeze, or further turmoil.

It will be interesting to see what happens today, because although we did recover a bit on Friday, it was not exactly impressive nor was it overwhelming to the upside. With this, it is very likely that rallies will be faded, so I continue to look for exhaustion to take advantage of. But if we break down below the lows of the last couple of days, I will not only be short of this market, I will be aggressively so. To the upside, I think we need to take out the 1.1750 level to be somewhat comfortable going long, so until that happens, I am either shorting this market or on the sidelines. If nothing else, maybe I will use it as an indicator of US dollar strength or weakness.