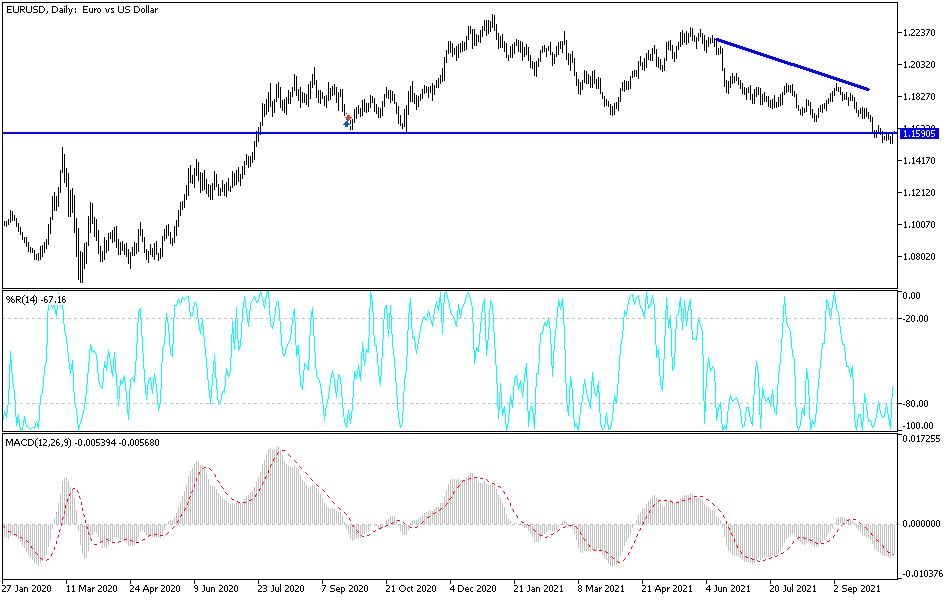

The euro rallied significantly on Wednesday to wipe out the losses from a couple of previous sessions. At this point, the market sits just below the 1.16 level, but it does look as if it is going to threaten to break out for a short-term rally. Nonetheless, even though things look very bullish for the euro all of a sudden, the reality is that the market is still very much in a downtrend, and most traders will be looking for signs of exhaustion to start shorting yet again. Because of this, I think that you are looking at a situation where you will have to be very patient.

I see resistance running from current levels to the 1.1650 level above, and any signs of exhaustion in that area will more than likely be jumped upon. That being said, if we were to break out above all of that, then you could see the market goes looking towards 1.17 level that is resistance extending all the way to the 1.1750 level. Because of this, the market is likely to continue seeing selling pressure over the longer term anyway, and it is not until we break above the 1.1750 level that I would consider getting long.

You can make a serious argument for the euro been oversold right now, and that would dictate that we probably need some type of bounce. The euro has been one of the worst performers of the majors recently, maybe due to the fact that the coronavirus figures in the European Union continue to climb. Furthermore, there are massive protests across the continent that might be weighing upon traders mind as well.

Adding even more fuel to the fire, or perhaps not enough oil, the fact that the European Union seems to be struggling to provide power is going to be a major issue as well. Economies run on energy, and if there is not enough energy, there is could not be enough economy. With all that being said and the fact that the ECB continues to extend its balance sheet at a rate much quicker than the Federal Reserve, I do believe that it is only a matter of time before the sellers return to this market. The 101.15 level underneath will continue to be stubborn though.