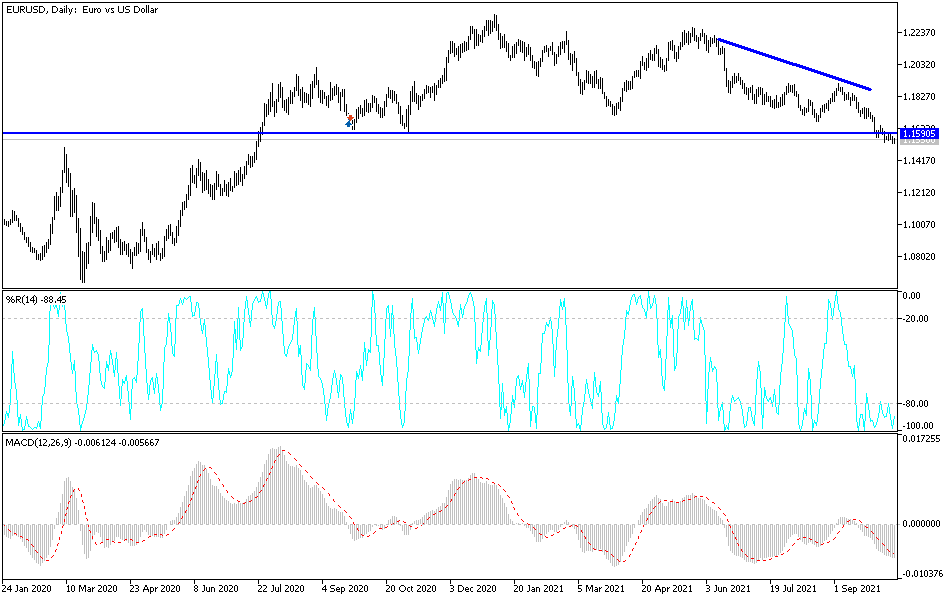

The euro continues to drift lower as it initially tried to rally but then gave back those gains to reach towards the 1.15 level. The 1.15 level is an area that will attract a certain amount of attention, as it is a large, round, psychologically significant figure. If we break down below there, then it could attract a lot more attention, as it would show so much in the way of negativity in this market. The euro continues to struggle due to the fact that the European Union cannot even powering itself at the moment, and of course COVID numbers are starting to pick up in the EU. With that being the case, the market is likely to see favoritism towards the US dollar and the bond markets.

Rallies at this point should continue to look at the 1.16 level above, which is an area that has been important more than once, extending to the 1.1650 level. After that, we have a significant amount of resistance at the 1.1750 level, an area that has also been important more than once. The market continues to see a lot of negativity, and I think that any time we rally, there will be plenty of sellers willing to jump in and take advantage of “cheap dollars.”

If we do break down below the 1.15 handle, then it is likely that we will go looking towards the 1.1250 level, maybe even lower than that. The euro is falling apart, and it does make sense that we would continue to see this behavior. The market will continue to be negative in general, and as a result I just do not have any interest in buying until we turn around and break above the 1.1750 handle, which would be a massive turnaround in order to show a complete change in attitude overall. That obviously would be a big deal, but right now it looks like we are nowhere near seeing that happen. Because of this, I am much more comfortable shorting signs of exhaustion than anything else, perhaps using short-term charts to enter these positions. I do believe that the 1.15 level is a significant level that will attract a lot of attention, but it certainly looks as if there is no signs that we are going to be able to rally for any length of time.