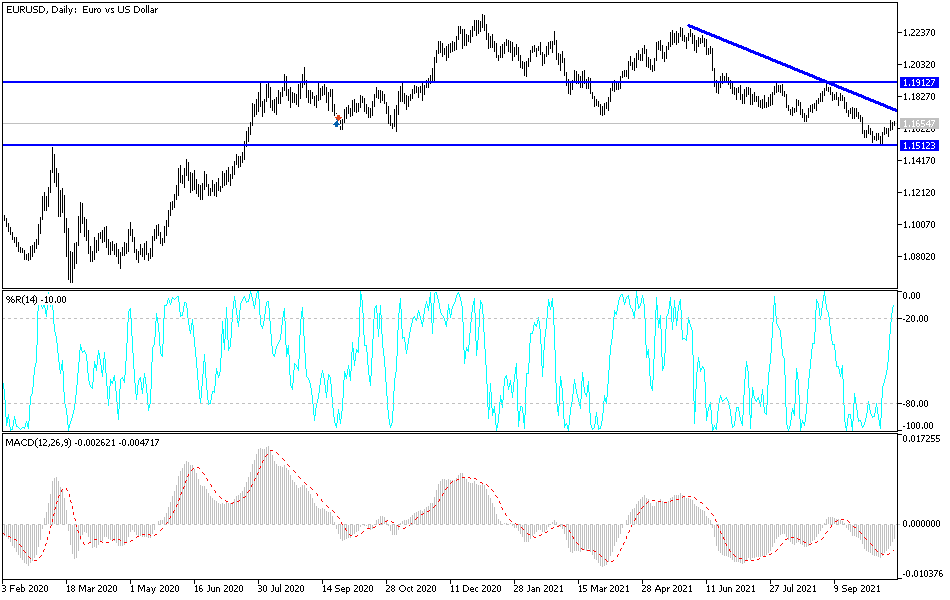

The euro initially pulled back just a bit on Wednesday but then turned around to show signs of life again. At this point, the market looks as if it is trying to break above the highs of the trading session on Tuesday, and if it does, we will more than likely see the euro try to get towards the 50-day EMA, presently sitting at the 1.17 region. On the other hand, if we turn around and break down below the 1.16 level, it is very likely that we will see the market break down towards the lows again, perhaps reaching towards the 1.15 level.

On a breakdown below the 1.15 level, it would be extraordinarily bullish for the US dollar, and would probably send this market much lower. It is worth noting that the euro has fared poorly against the US dollar, despite the fact that it has been positive over the last 10 days or so. After all, while the euro has gained ever so slightly, other currencies, such as the Australian dollar and British pound, have really started to take off. It looks as if we are ready to have a bigger move happen, and it will probably drag the euro right along with it. The market closing at the very highs of the session is a very bullish sign as well, so it is very likely that we will see a bit of follow-through. Breaking the top of the candlestick from the Tuesday session also negates a shooting star, which is a very powerful sign in and of itself.

Even if you are not trading the euro overall, you can keep in the back of your mind that this is almost the same thing as the US Dollar Index, so if nothing else it will give you an idea as to how to trade the greenback against other currencies around the world. The currency pair as one that I use a lot to get an idea as to how to trade the greenback against many other markets, and that is essentially what makes this an indicator more than a market from what I see. That being said, if we do clear the 50-day EMA it is possible that we could see momentum building.