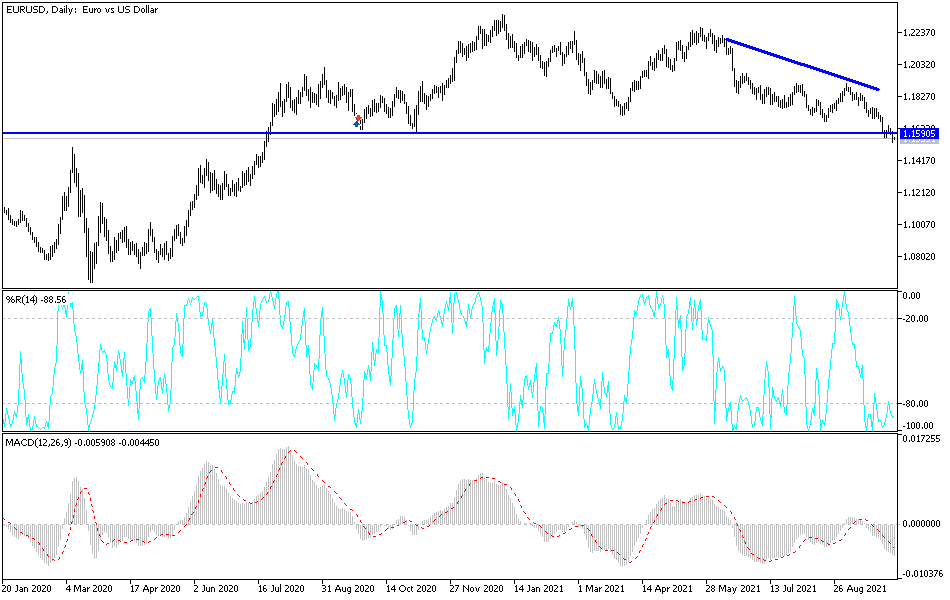

The euro broke down significantly on Wednesday to reach down towards the 1.1550 level. Furthermore, it has also tested that downtrend line that I have marked on the chart from the month of June. We ended up forming a massive “megaphone pattern”, which typically suggests a reversal, but we have no confirmation, so at this point it is just simply a trendline.

The candlestick closing right around the 1.1550 level does suggest that we have further to go, but we have bounced ever so slightly from the lows. I think the 1.16 level above is significant resistance, as it had been significant support. You can also make an argument that we just broke down from a bearish flag, which measures for a move towards the 1.15 level. This also ties together quite nicely, due to the fact that the 1.15 level will be important from a psychology standpoint.

In fact, it is not until we break above the highs of the Monday session that I would even remotely consider buying this pair, and as a result I am simply looking for some type of exhaustion that I can fade. I believe that the market will eventually try to figure out where to go next, but as things stand right now is likely that we will continue to see downward pressure. If we break down below the 1.15 handle, then it is likely that we fall apart and go looking towards the 1.1250 level.

The Friday session of course features the non-farm payroll figure, and that will make quite a bit of influence in the market when it comes to the US dollar. The US dollar has been one of the biggest drivers of this pair, but you should also keep in the back of your mind that the European Union is struggling to power itself right now, and we are seeing a massive shutdown to when it comes to heavy industry. If that is going to continue to be the case, then it is hard to imagine that the European Union is going to be a place where you want to throw a lot of money into. That being said, I do think that we are getting a little bit oversold, so a short-term bounce would make some sense, but I will be looking to take advantage of that unless told otherwise.