The Euro has been significantly wounded over the last several sessions, as we continue to drift lower. The ECB is very likely to stay very loose with its monetary policy going forward, while the Federal Reserve may very well find itself tightening sooner rather than later. The markets continue to be very noisy, but the Euro has been selling off as the European situation continues to deteriorate. After all, the European Union is having issues even fueling itself.

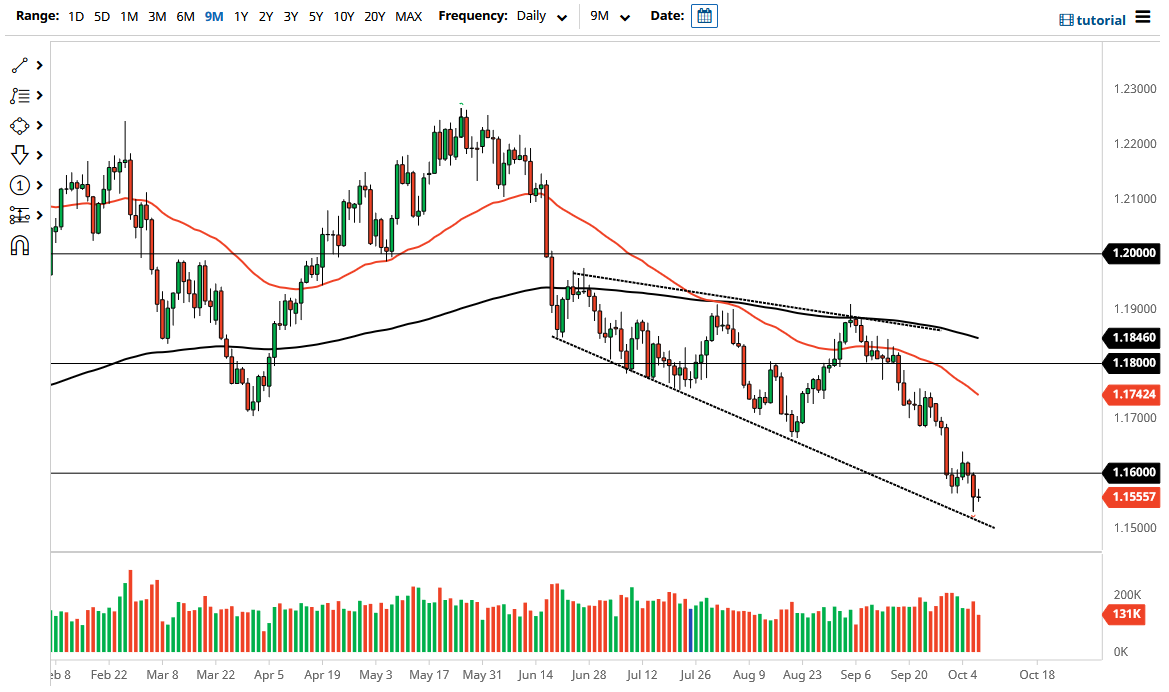

To the upside, the 1.16 level should offer a bit of resistance, even if we do get the short-term burst after the jobs number. If that does in fact happen, I am looking for signs of exhaustion in that general vicinity that I can take advantage of. I am hoping to see some type of exhaustive candle that I cannot short, but if we break above the highs from the week, then I anticipate that the Euro will probably continue to go looking towards the 1.17 level above where I would anticipate seeing even more resistance.

The candlestick on Friday will be very telling, so we are probably going to be better off waiting for a daily close unless of course we get a fresh, new low because at that point the market is going to go slamming into the 1.15 handle. Whether or not that holds is a completely different question, but the reality is that there is only psychological support there more than anything else from what I see on the charts. We are most decidedly in a downtrend, so that is a move that is much easier to see work out than a countertrend move.

If we rally, then I am simply going to wait for a long wick to start shorting, even if that means waiting until Monday. All things been equal, it looks very much like the market is going to try to slash through the 1.15 handle and go looking towards the 1.1250 level over the longer term, the question now is whether or not the jobs number will boost that move if it is extraordinarily strong? At this point, that is about the only part of the economy that the Federal Reserve has an excuse to keep monetary policy loose at. If that leg of the table falls, the whole thing comes crumbling down and tapering begins in earnest.