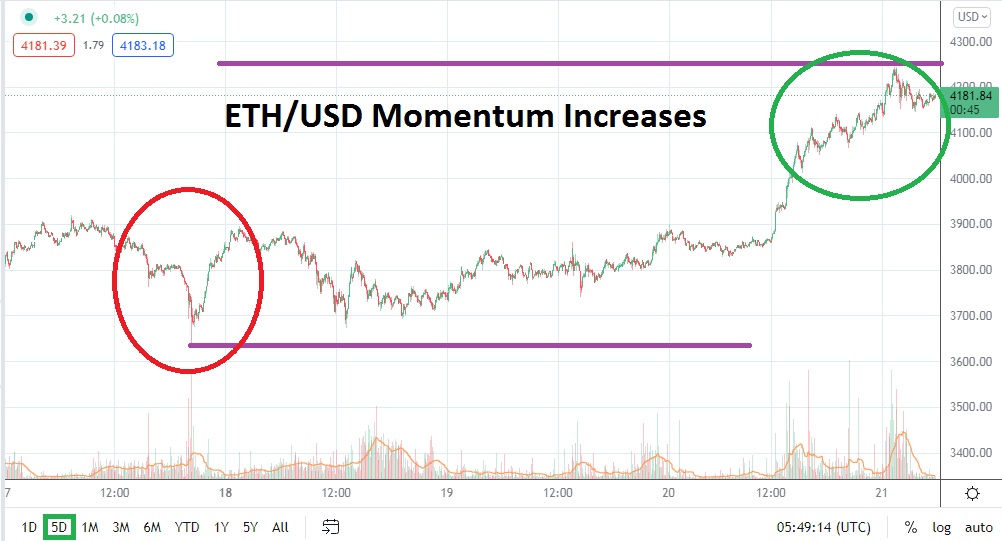

ETH/USD has not hit all-time highs quite yet, but it certainly appears to be demonstrating an ability to flirt with its record value. A high of nearly 4250.00 was attained late last night and, as of this writing, Ethereum is trading a touch below the 4200.00 mark. A record value of nearly 4400.00 was attained on the 12th of May this year. For speculators new to the world of cryptocurrency, you are advised to make sure your seat belts are fastened tight.

ETH/USD has again entered the realm of massive exuberance, but intriguingly, the current bullish rally in the digital asset actually seems to be rather comfortable. After hitting last night’s high, ETH/USD did not suffer a major reversal lower, and traders who have been fortunate enough to be trading Ethereum with long positions have hopefully cashed in some of their profits. There may be a group of speculators who have bought ETH/USD and plan on holding on longer and if this is the case, hopefully they are using trailing stops as the cryptocurrency moves upwards to protect a large percent of their winnings.

Technical resistance can be said to be near the 4200.00 mark temporarily. However, this is more of a psychological barometer and a number which has little credence except as a marker. The fact that ETH/USD has maintained its higher ground and continues to traverse near its record prices is an indication that there may be greater heights to climb. In the middle of May, when ETH/USD astonished the speculative world with record values, the realms it is maintaining now were hard to hold onto and it crashed back to earth eventually.

If ETH/USD continues to sustain its current thresholds and support remains durable near the 4150.00 to 4100.00 levels, speculators cannot be blamed for wanting to purchase a ticket on the potential rocket ride higher. However, this is not a mere amusement park, traders are not buying something with a guaranteed profit, real danger lurks. If ETH/USD declines in value it can happen quickly and the impact may cause pain. The use of stop loss orders is highly advised and leverage must be carefully chosen.

Buying ETH/USD at its current values may feel dangerous, because it is. However, if a trader chooses their entry point carefully and is able to withstand the emotional ride they will encounter, buying ETH/USD and looking for higher realms could prove worthwhile. If ETH/USD is able to break through the 4250.00 level short term, Ethereum may be able to achieve new record values near term.

Ethereum Short-Term Outlook

Current Resistance: 4240.00

Current Support: 4094.00

High Target: 4400.00

Low Target: 3990.00