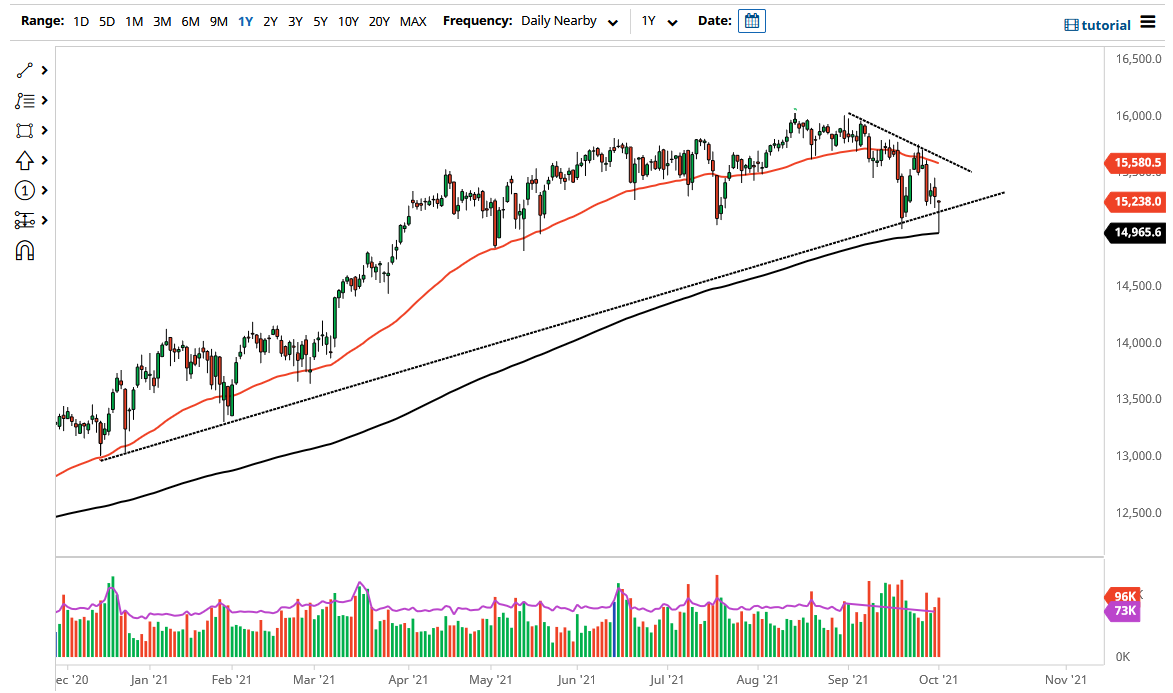

The DAX Index initially plunged on Friday after gapping lower. However, there has been quite a bit of buying pressure as the market reached towards the 200-day EMA. This is an indicator that a lot of people pay close attention to, so it's no surprise that we turned around to form a bit of a hammer. The hammer is a very bullish candlestick, and at this point, if we break above there, it is possible that we may make a move to the upside.

The DAX is a leader when it comes to the European Union, so pay close attention to what happens here. Because of this, if the market were to take off to the upside, then it should drag the rest of the indices on the continent right along with it. After all, the DAX is considered to be the “blue-chip index” of the continent, so that is a huge deal if we do see a big turnaround.

On the other hand, if we were to turn around and break down below the hammer from the session on Friday, it would have the market clearing the 200-day EMA to the downside, opening up fresh selling. I do not necessarily think that is going to be easy to make happen, but if we do, then I anticipate that we will go looking towards the 14,500 level rather quickly. The market has been in an uptrend for quite some time, so that would obviously be a stunning turnaround.

With all of this being said, in order to feel comfortable going long, we would need to see the Thursday candlestick overcome, at least on a daily close. That would be a very bullish sign, and although there is a significant amount of resistance above there, it would be a big enough turnaround to perhaps look at this through the prism of a double bottom that has just formed. Obviously, double bottoms do not happen every day, so the fact that we have formed this is something worth paying attention to and could be something rather important when we break away from it, no matter the direction. The DAX moves right along with risk appetite, so if risk appetite picks up, it is likely that the DAX will continue to levitate.