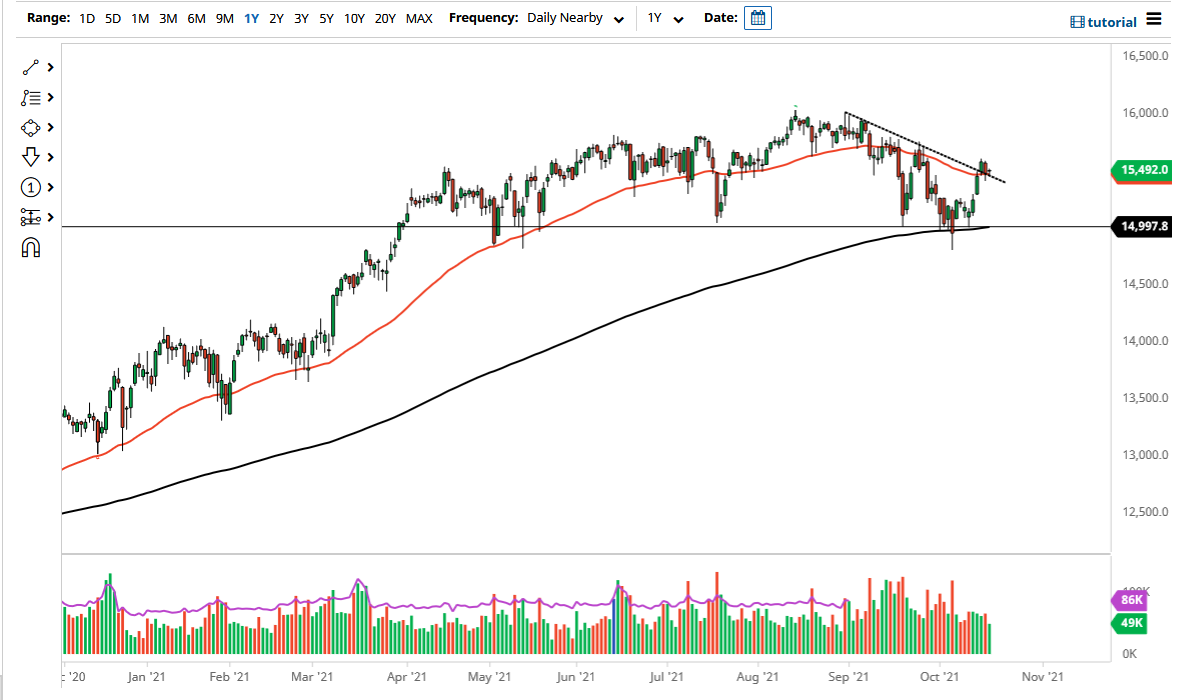

The DAX Index was relatively quiet on Tuesday, reaching down towards the 50-day EMA in order to show signs of support. We have bounced just a bit, but at the end of the day the relatively small range suggests that we are simply killing time. It is worth noting that we are hanging around the 50-day EMA, but it is even more interesting that we are hanging around the 15,500 level, an area that would attract a certain amount of attention in and of itself.

The market breaking above the highs of the last couple of days would almost certainly send this market towards the 16,000 level and continue the overall uptrend that we have seen. This downtrend line that we are hanging on top of should offer a little bit of support, so as long as that is going to be the case, then I think buyers will continue to look towards the DAX. It is worth noting that Europe has a lot of issues that other parts of the world do not have in the form of coronavirus infections, but as we all know by now, stock markets have very little to do with what is going on in the real world. If that were the case, then we would actually get a bear market that lasts for more than about 10 minutes.

That being said, that is the game that we are all playing so you need to understand the rules. Pullbacks continue to be bought into as they offer bits and pieces of value, and I do believe that as long as we can stay above the 15,000 level, it is very likely that we will find value hunters getting involved. The 200-day EMA sits right at the 15,000 level as well, so that makes for a very good “floor in the market” from what I can see. The DAX is the first place that people put money into when it comes to the European Union, as it is considered to be a “blue-chip index” for the continent. Because of this, I have no interest in shorting, and I do think that it is only a matter of time before we reach towards the all-time highs again.