Last Wednesday’s BTC/USD signal produced a very profitable long trade from the bullish bounce off the identified support level at $54,272.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades may only be entered prior to 5pm Tokyo time Tuesday.

Long Trade Ideas

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $61,218 or $58,906.

Put the stop loss $100 below the local swing low.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $62,558, $63,856, or $64,945.

Put the stop loss $100 above the local swing high.

Adjust the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

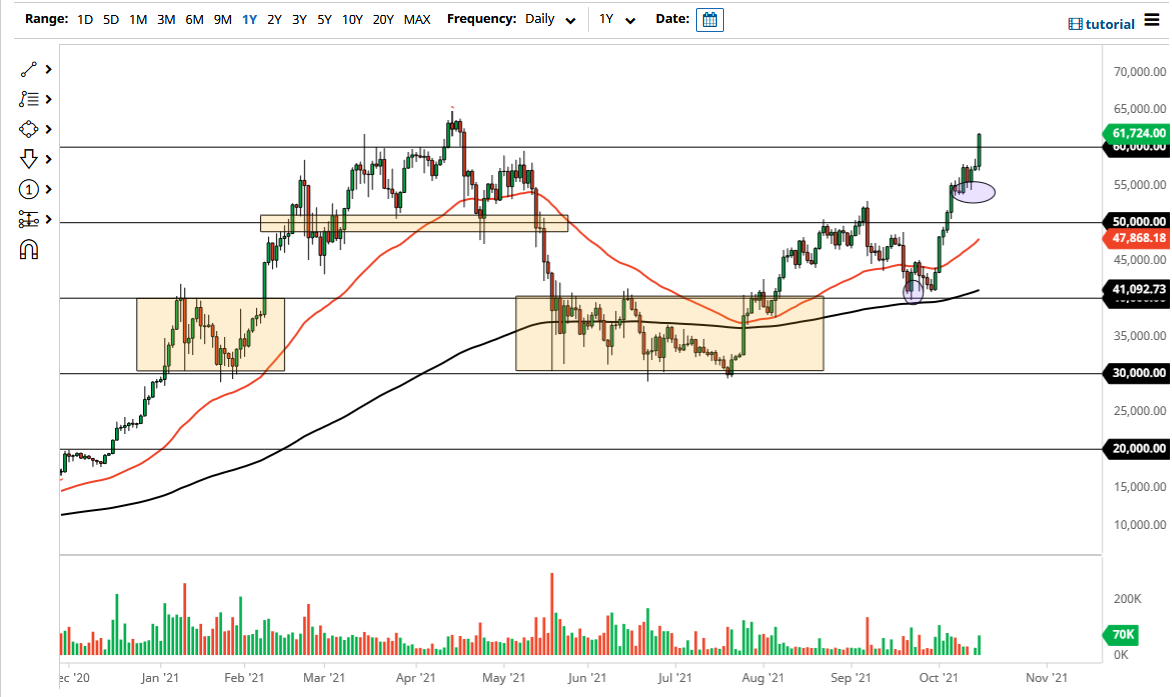

I wrote last Wednesday that we had a more bearish technical picture, which showed signs of the price topping out below $58k. However, I also said that $54,272 looked like a very crucial level now, and that bulls were still in with a chance buying any bounces off this level which may happen today. This was a good call.

The price has continued to advance with healthy bullish momentum since last Wednesday but has now run into strong overhead resistance at $62,558 which may be printing a bearish double top although it is too early to make that call.

It looks like odds are in favour of a break above $62,558 and an advance to test the all-time high price just below $65k so this is a crucial time for Bitcoin. The price may instead hold below $62,558 and make a bearish retracement. Still, I would not look to take any short trade in Bitcoin today, and if there is a bearish retracement now, I will be very prepared to buy from any bullish bounce which might happen at either of the two closest support levels.

The bullish momentum is probably helped by the fact that the first Bitcoin futures exchange traded fund (ETF) looks set to launch any day now after effectively receiving a green light from the SEC last week. This will make buying Bitcoin much more accessible to retail investors without requiring physical ownership of Bitcoin and its associated headaches.

Regarding the USD, there is nothing of high importance scehduled today.