Bullish View

Set a buy-stop at 0.7320 and a take-profit at 0.7400.

Add a stop-loss at 0.7250.

Timeline: 1-2 days.

Bearish View

Set a sell-stop at 0.7280 and a take-profit at 0.7200.

Add a stop-loss at 0.7350.

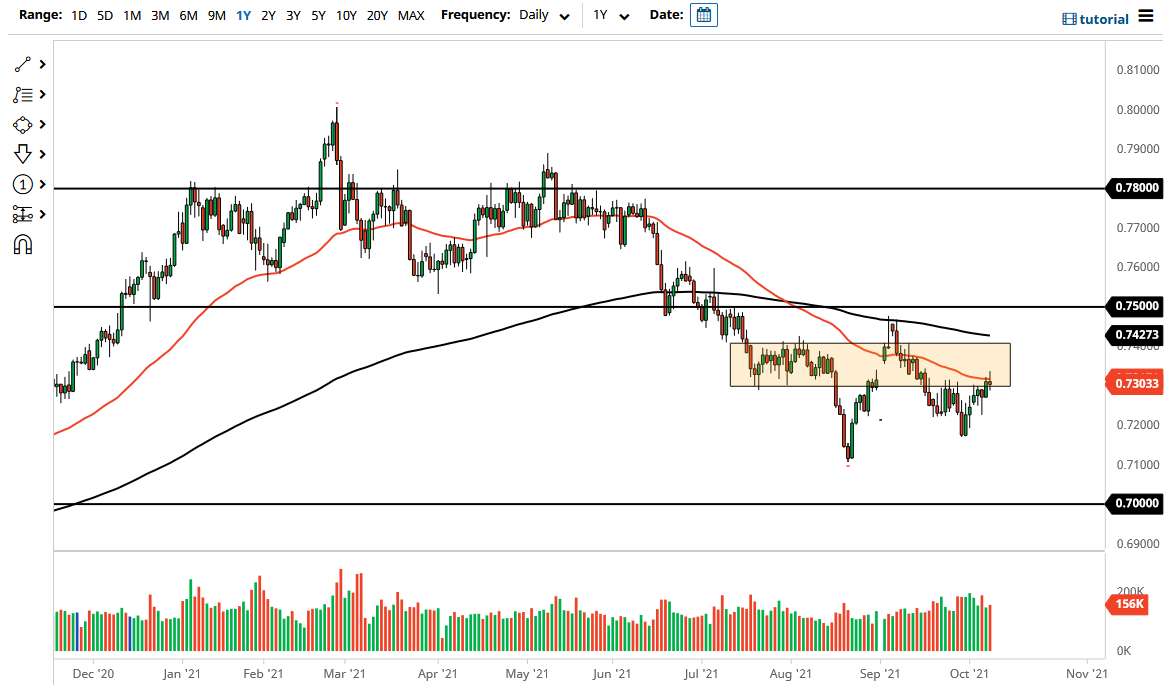

The AUD/USD price was unchanged in early trading as the market focused on the recent American jobs numbers. The pair is trading at 0.7305, which was slightly below last week’s high of 0.7340.

US and Australia Jobs Data

The US published mixed jobs data on Friday. The data revealed that the country’s labor market continued to face significant challenges in September. While job vacancies remain high, the economy managed to add just 194k jobs. This was the smallest monthly increase in months.

On the positive side, the country’s participation rate held steady at 61.25 while the unemployment rate declined to 4.8%. This was the lowest unemployment rate since the pandemic started.

The next major economic data to watch from the US will be the country’s inflation numbers scheduled for Wednesday this week. These numbers will provide more details about whether the country’s economy is sinking into stagflation, a period where high inflation coincides with high unemployment rate.

The data will also show the impact of the rising gasoline and gas prices. In the past few weeks, the price of crude oil has jumped to a seven-year high while gas has jumped to an all-time high. The Fed has long insisted that the current wave of inflation is transitory.

Meanwhile, the Australian statistics agency will publish the country’s employment data on Wednesday. Economists expect that the Australian economy declined by more than 120k people in September after it lost an additional 146k in August. Its unemployment rate is expected to rise from 4.5% to 4.8%.

Still, the Australian economy will likely rebound in the coming months because of the trends in vaccination. The country is also expected to reopen its borders for foreign tourists in the coming weeks.

AUD/USD Forecast

The four-hour chart shows that the AUD/USD pair has been in a tight range recently. It has found substantial resistance at the current range, which is important because it was the highest level in September. The 25-day and 50-day moving averages have also made a bullish crossover while the price is between the 50% and 38.2% Fibonacci retracement level.

Therefore, the pair will likely break out higher this week. If this happens, the next key resistance level to watch will be at 0.7400, which is slightly above the 38.2% retracement level.