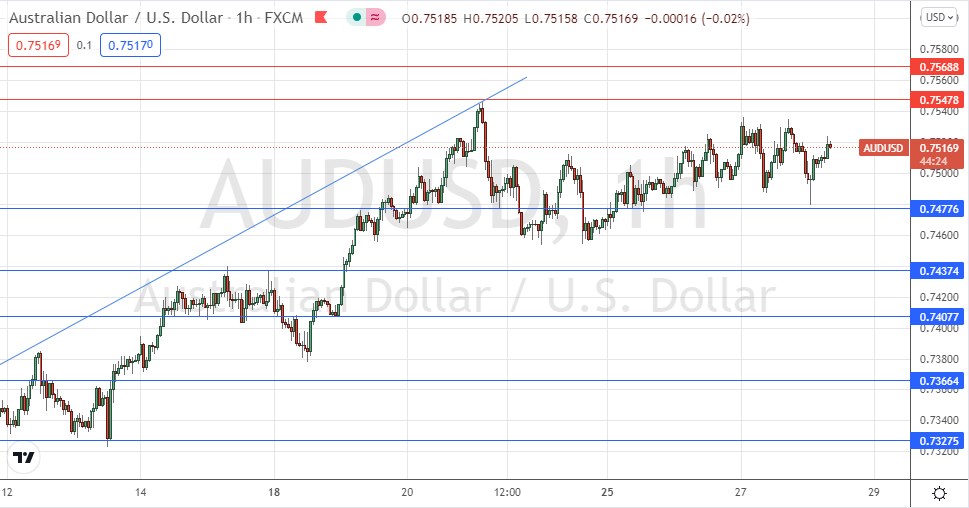

Last Tuesday’s AUD/USD signal produced a losing short trade entry from the bearish rejection of the resistance level I identified at 0.7524.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered prior to 5pm Tokyo time Friday.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7548 or 0.7569.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7478 or 0.7437.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that it seemed likely that the price would consolidate below 0.7524, and that there was further resistance not far beyond that.

I was mostly correct although the price has managed to get just a few pips beyond 0.7524.

We see the price still acting bullishly and respecting support, but there has been little change as we still see this area of strong resistance below 0.7600, and I continue to doubt whether the price can reach much higher over the short term. Having said that, the price does not look ready to begin falling in a meaningful way either.

I think the best approach here is to wait for the price to reach either 0.7550 or 0.7600 and enter a short trade if there is an attractive bearish reversal. The chances of success may not be high but the potential risk reward ratio is great as 0.7600 could easily be a long-term high.

It is interesting that the AUD, along with the New Zealand dollar, is still firm when we see stock markets and other risky instruments looking weak. However, it is true that price fluctuations over recent days have been small, so it may not be the right thing to do to read too much into these relatively small price movements.

Regarding the USD, there will be a release of Advance GDP data at 1:30pm London time. There is nothing of high importance scheduled concerning the AUD.