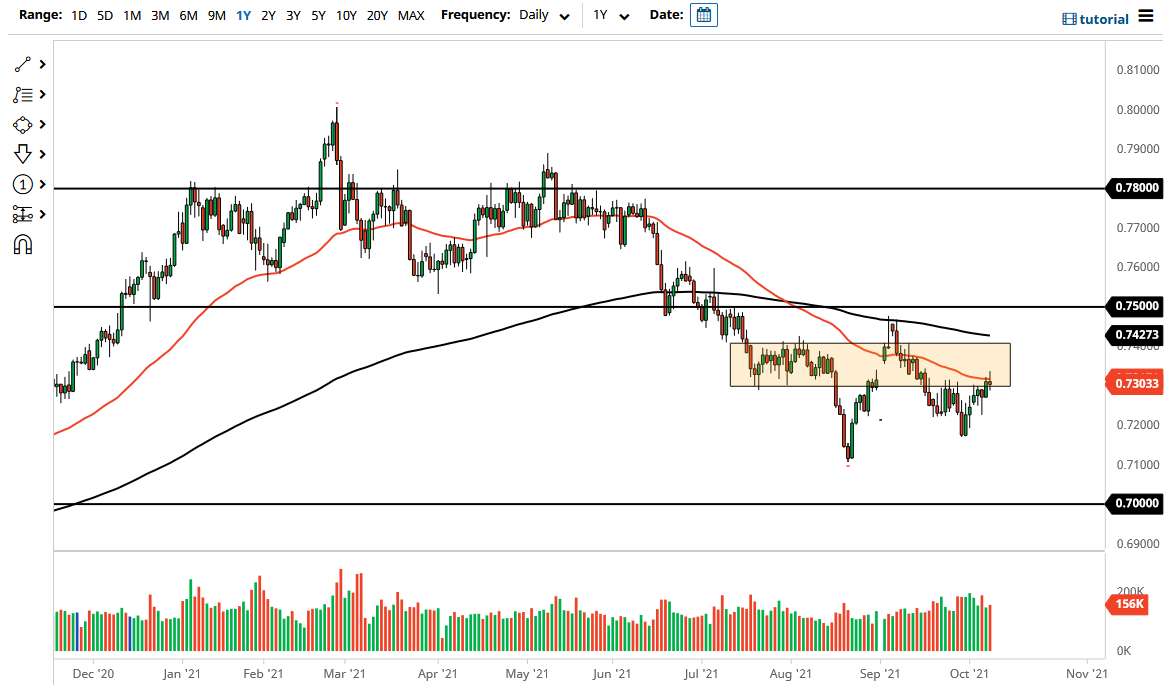

The Australian dollar fluctuated on Friday as the 50-day EMA has shown a bit of resistance. At this point, the market looks as if it is forming a bit of a shooting star, which is a somewhat negative situation. If we break down below the bottom of the candlestick, then it is likely that the market will go looking towards the 0.72 handle.

At one point during the trading session, this was a market that looked like it was ready to take off, but it is worth noting that the buyers disappeared later. The area between 0.73 and 0.74 continues to be an area that is very difficult to deal with, and as a result it is likely that we have seen enough noise in this area previously to make it very difficult to gain longer term. In fact, it is not until we break above the 0.74 level that I would be comfortable getting long of this market, because the market will have completed a “double bottom” as a general rule.

To the downside, the market breaking down below the bottom of the candlestick for the trading session on Friday could open up a move much lower, perhaps reaching towards the 0.72 handle. Keep in mind that the Australian dollar is highly driven by the Chinese connection and risk appetite in general. Whether or not we continue to see risk appetite continue is the real question as to where we go next. At this point in time, the market continues to hear a lot of noise, and I think as long as we have fear out there, this is a pair that will favor the US dollar.

The US dollar could get a boost due to higher interest rates, or on the inverse of that situation, when people are jumping into the bond market. In other words, it might be a “heads I win, tails you lose” type of situation. Instead of worrying about the narrative, I am simply going to follow what happens next and trade accordingly as the massive amounts of noise out there will continue to make trying to figure out what is actually going through the heads of most traders almost an impossible task. Do not worry about the narrative, simply follow the market.