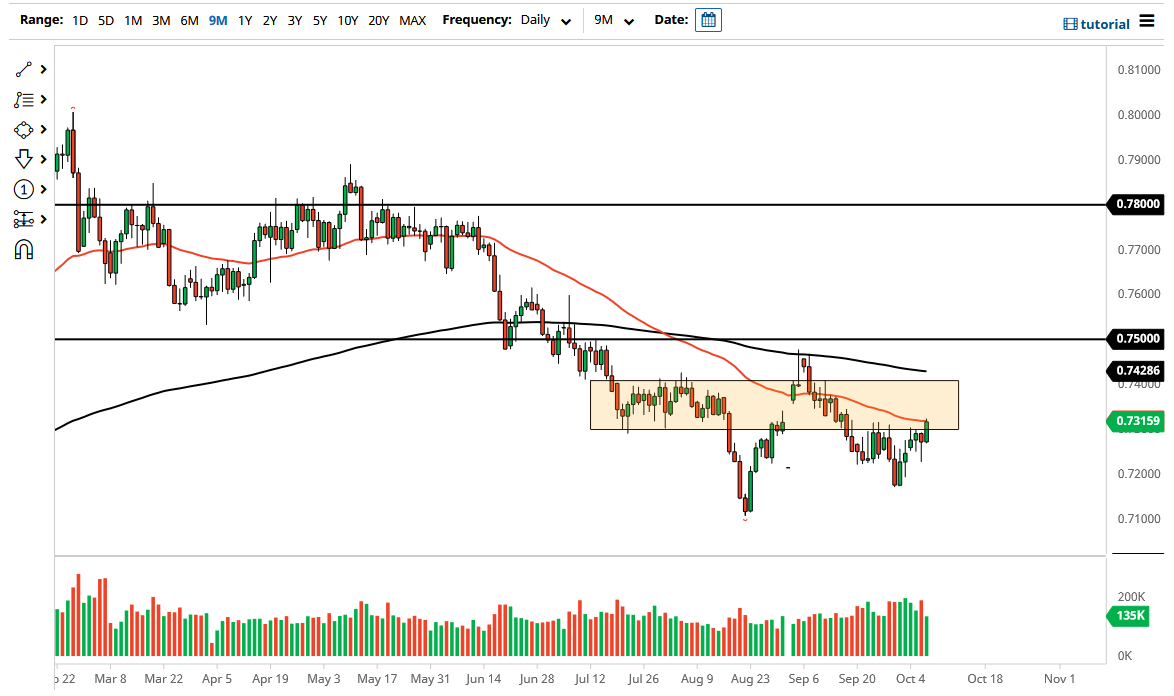

The Australian dollar has rallied significantly during the course of the trading session on Friday to break above the crucial 0.73 level. There is still a lot of noise in this general vicinity that we need to pay attention to, as the market had been stuck between the 0.73 and the 0.74 level for a while. Because of this, it is likely that we will continue to see an area above that will be difficult. That being said, we have the Non-Farm Payroll numbers coming out on Friday and that should continue to see plenty of volatility. Quite frankly, this will come down to whether or not it looks like the Federal Reserve are going to taper or not.

Because of this, the market is likely to see difficulty over the next 24 hours, and as a result it is likely to be a market that you need to be very cautious with. There is a lot of noise between now and 0.74, but if we were to turn around a break above there, then I might be willing to buy the Australian dollar, but at this point in time I think it is a very difficult to put a bunch of money into the market at this level. Once we get through the jobs number, then I might be willing to put some money to work but until then I think you need to be very cautious because we could get some type of shock that throws this market into a bit of a tizzy. Because of this, it is very likely that we will see this market as one we can trade from a longer-term standpoint very soon, but right now you need to lock the Federal Reserve expectations come into play, as it will be the biggest driver of where this pair goes next.

Keep in mind that the Chinese default situation continues to be a problem for the Australian economy, and of course the lack of demand for certain commodities may weigh upon the Aussie as well. That being said, it is a very uneven reaction about the reopening trade across-the-board so this should continue to cause major issues. To the downside, if we can break down below the hammer from the Wednesday session, that opens up a move to a much lower level. On the other hand, if we can break above the 0.74 level, this market could really start to move to the upside.