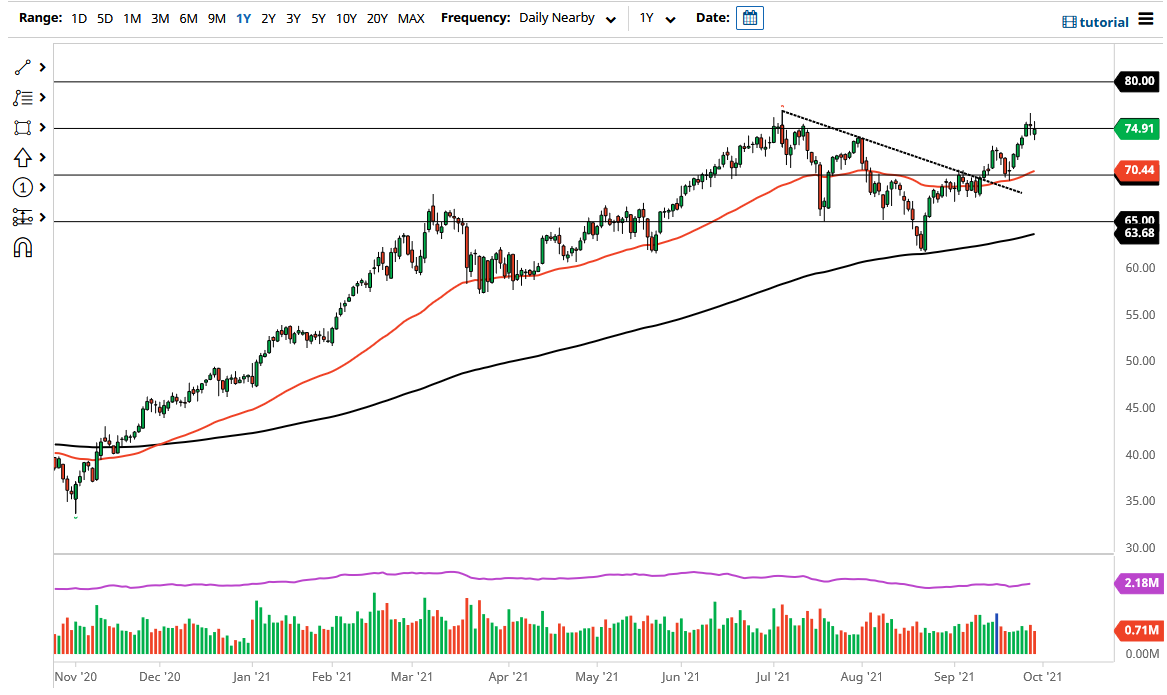

The West Texas Intermediate Crude Oil market initially dipped a bit on Wednesday but then turned around to rip into the $75 level. The $75 level is a large, round, psychologically significant figure, and it makes sense that we would see this area tested and perhaps a little bit of a pushback come into the picture. Furthermore, you also have the shooting star from the previous session, which is negative as well. Adding more downward pressure is the fact that the inventory numbers showed a surprise build, but really at the end of the day this is about the forward look for the markets.

If we do break down below the bottom of the candlestick on Wednesday, then it is likely that we could go looking towards the $72.57 level, perhaps even down to the 50-day EMA. The 50-day EMA breaking above the $70 level could be a bullish sign, and as a result it is likely that that level should be a massive “floor in the market” and we would see a lot of interest there.

On a breakdown below the $70 level could be a significant move to the downside just waiting to happen, but I think it would take a certain amount of pressure to make that happen. Crude oil continues to see a lot of demand going into the future, especially if the market sees more demand coming out of places like Europe as the winter months come into the picture. After all, heating demand will pick up and it is obvious that natural gas supplies are struggling to keep up, right along with any of the renewables. You cannot be shorting this market anytime soon, unless something fundamentally changes in a drastic way. That is very unlikely to happen anytime soon, at least not until we get through the winter, so I believe that short-term pullbacks will continue to be buying opportunities. Keep an eye on the US dollar though, because it does have a bit of a negative correlation, and if we continue to see a spike in the greenback it could be like a wrecking ball through various financial markets.