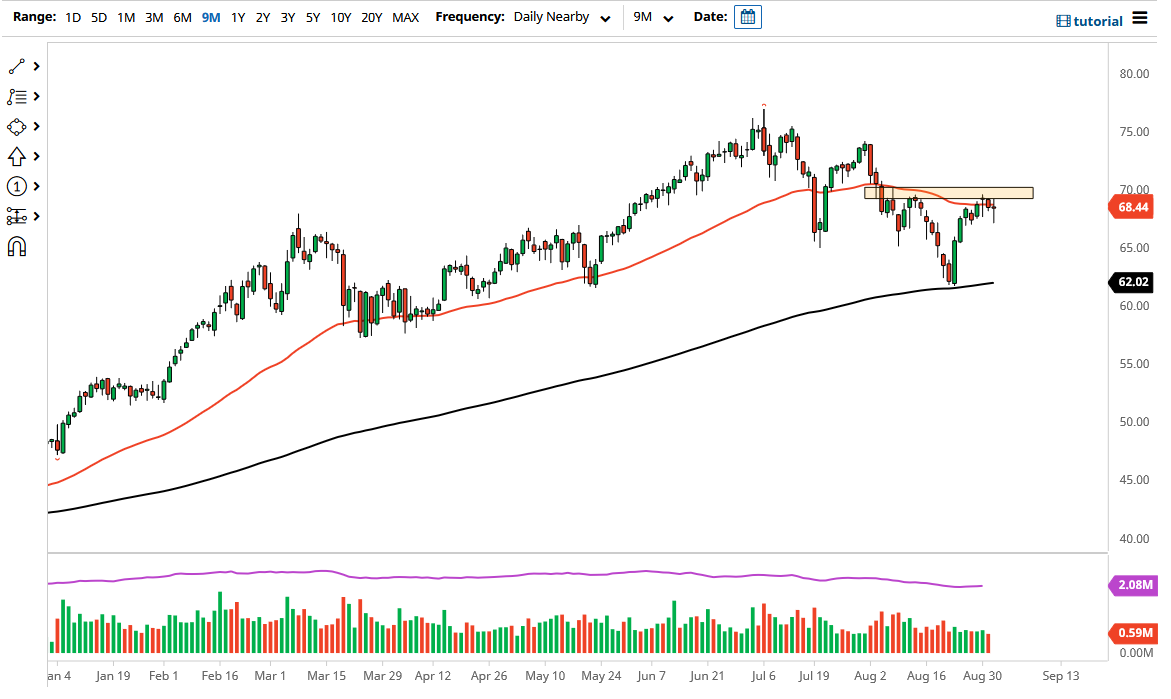

The West Texas Intermediate Crude Oil market initially pulled back just a bit on Wednesday to show signs of hesitation, before turning back around to form a significant hammer. The hammer is a bullish sign, and if we can break above the $70 level next, then we could take off to the upside, perhaps reaching towards the $74 level. From a technical analysis standpoint, it looks as if that could be the next move, but it should be noted that we had already formed a hammer on Monday that has been broken below, so someone could suggest that perhaps we have already kicked off a so-called “hanging man.”

At this juncture, if we were to break down below the $67 level, I think it is likely that we will continue to go lower, perhaps down towards the $65 level, following which we could then go looking towards the $62 level which is where the 200-day EMA currently sits. That is a major trend-defining indicator, so a lot of people will be paying close attention to that level. I anticipate that there could be quite a bit of value hunting in that area, but ultimately breaking that opens up a massive bear market.

Pay attention to the US dollar, because it will certainly have a certain amount of influence on crude oil as usual, andthe jobs number on Friday could come into play as well. The jobs number falling significantly could suggest that perhaps there will be less demand for crude. That being said, OPEC has decided to extend production, so that should in and of itself be a little bit negative as well. Nonetheless, this is a market that I think will continue to see volatility and choppiness, but I think you have to look at this through the prism of whether or not this is a descending channel, or if it is just a nice pullback that we can continue to buy into based upon the global reopening trade. As long as that is what people are looking at, the reality is that crude oil will probably go higher, but we obviously have to get through the barrier to go much higher. Expect noisy behavior, but eventually we could get some type of clarity.