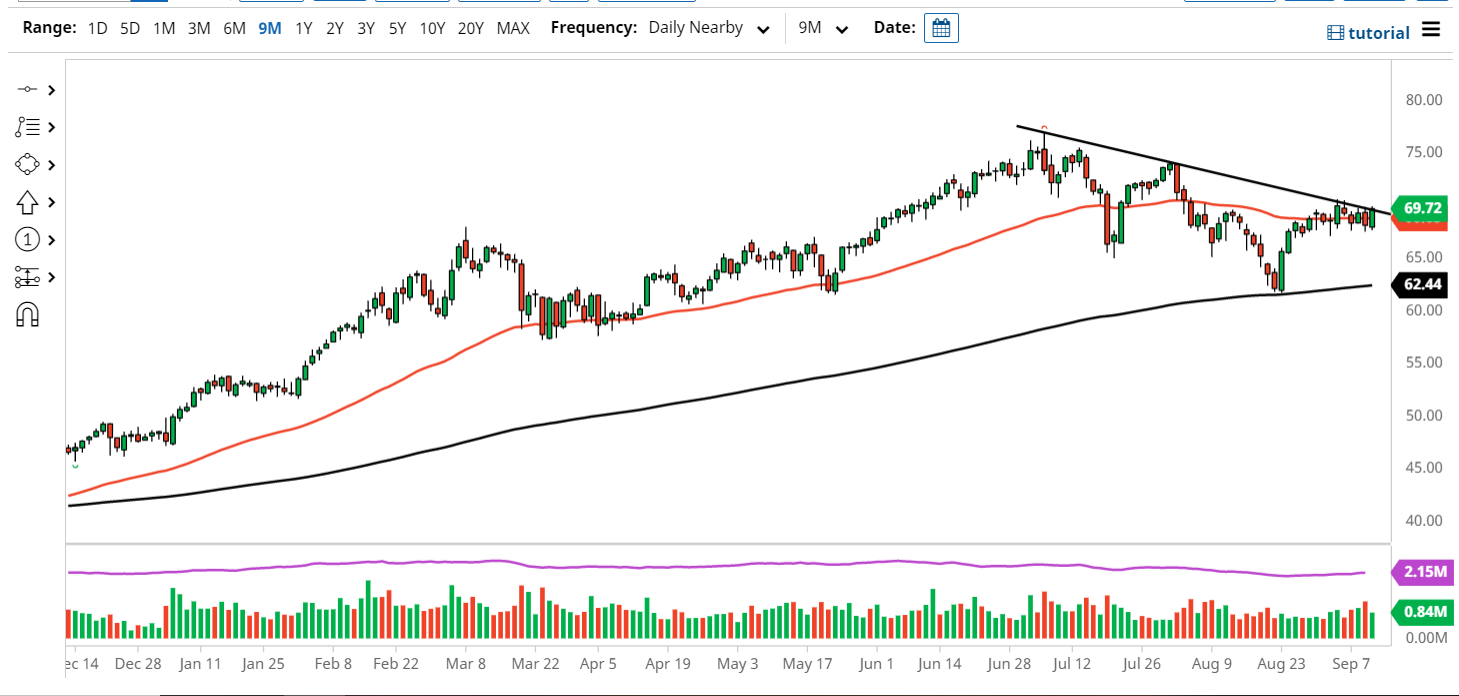

The WTI Crude Oil markets continue to show signs of strength, but are also stymied by the downtrend line that I have marked on this chart. Just above the downtrend line there is the $70 level, which has a certain amount of psychological importance built into it. Because of this, I think most traders are probably paying more attention to the psychology of a round number than they are this simple trend line.

The 50-day EMA happens to be slicing through their most recent price action, so it does make sense that we would see congestion here. Furthermore, there are a lot of questions as to whether or not demand is going to pick up going forward. At the same time, OPEC has started to increase production which will drive down some of the pricing power. Late Thursday night, the Chinese released crude oil from their strategic reserve to fight rising prices.

Perhaps the most important thing to pay attention to at this point in time is going to be the US dollar. After all, the commodity is priced in that currency, so if the dollar starts to rise, that can often put downward pressure on the market. That being said, I do not expect to see any type of meltdown, but if we were to break down below the $67.50 level then I believe the markets could go looking towards the $65 level next. Underneath there, we have the 200-day EMA just waiting to cause a little bit of supportive action as well.

To the upside, breaking above the $70 level on a daily close should send this market looking for the $74 level which is an area that traders will be looking towards, as that's where sellers had jumped into the market previously. The market is more than likely going to be somewhat choppy over the next couple of sessions, but this makes sense as we are getting ready to kick off the next leg either higher or lower. A lot of people are focusing on inflation, and energy is a decent bet against that, so that is part of what is causing the rising demand. Ultimately, by the end of the week we should have a good sign as to where the next $5 will be made.