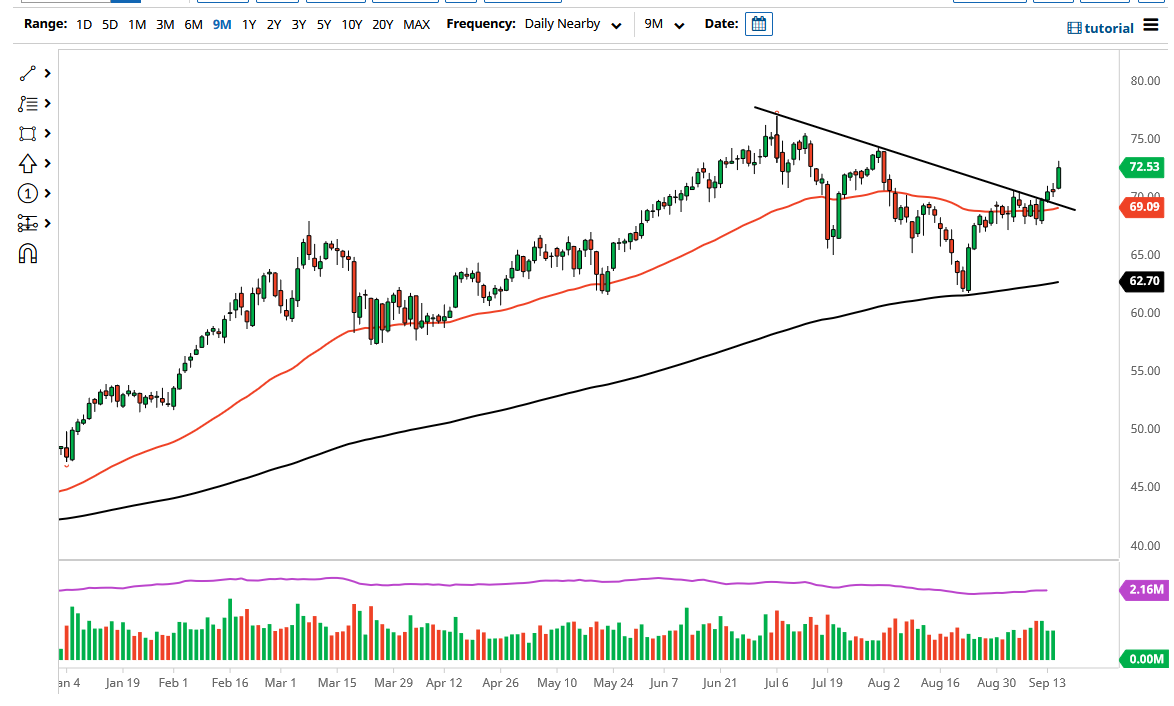

The West Texas Intermediate Crude Oil market has rallied significantly during the course of the trading session on Wednesday to finally break above the short-term resistance that had been seen late during the day on Tuesday. By doing so, the market then had a bit of a short squeeze going, as we reached above the $72.50 level. With that in mind, the market is very likely to continue seeing plenty of buyers on dips.

The bottom of the candlestick should now be massive support, as we broke out of that neutral candle from the previous session. We are also above a major trendline, which had been keeping the market at bay for most of the summer. The question now is whether or not the demand will actually pick up in order to drive pricing higher? At this point, demand for crude oil is picking up not only due to the idea of more transportation, but also due to the need for fuel going forward from a power standpoint as well. After all, natural gas has spiked unbelievably high, as the market will shift from natural gas to petroleum to make up the difference.

There is a lot of concern when it comes to the United Kingdom right now as they have lost a lot of power production as a major cable was cut. That being said, the market is likely to see a lot of demand being picked up by multiple processes. Nonetheless, the market is likely to see crude oil go higher from a technical analysis standpoint anyway. The 50 day EMA sits underneath and offers support, but it is also starting to curl to the upside. The $74 level above is an area where there had been a significant amount of resistance. If we were to break above there, then the market is likely to go looking towards the $75 level next.

If we were to break down below the 50 day EMA, that would obviously be a very negative sign, perhaps even opening up the possibility for a move down to the $67.50 level. That is an area where we have seen a lot of buying pressure previously, so breaking down below there then opens up massive selling. Pay attention to the US Dollar Index as well, because it also has a bit of an influence here as well as the two can be negatively correlated.