The markets are awaiting the US job numbers, which may confirm Fed Chairman Jerome Powell's recent warning, or support expectations of a tightening of the bank's policy. The USD/JPY is moving above the 110.00 psychological resistance again with gains to 110.26 as of this writing. This move comes before the announcement of the preliminary reading of the US labor market ADP to measure the change in the number of US non-farm payrolls, along with the ISM Manufacturing PMI reading. The results of the latest US economic data suffered a setback.

Yesterday it was announced that US consumer confidence fell in August to its lowest level since February amid growing concerns about the rapid spread of the delta variant of the coronavirus and concerns about rising inflation. The Conference Board reported that the US Consumer Confidence Index fell to a reading of 113.8 in August, down from a revised 125.1 in July. It was the lowest level for the index since a reading of 95.2 in February. The July index was revised down from an initially reported 129.1 which followed a reading of 128.9 in June, the best showing since before the pandemic broke out in February 2020.

The Conference Board said concerns about a resurgence of COVID cases as well as concerns about rising gas and food prices contributed to the decline. As August fell, the general index was down 19 points from its pre-pandemic level. The decline in August reflected weak current conditions and expectations components for the index. The report showed that spending intentions on buying homes, cars and major appliances cooled in August, but the percentage of consumers intending to vacation in the next six months continued to rise.

Commenting on the results, Lynn Franco, senior director of economic indicators at the Conference Board, said: “While the resurgence of COVID-19 and inflation fears has dampened confidence, it is too early to conclude that this decline will lead to consumers cutting back their spending significantly in the coming months..."

The decline in the Conference Board's monthly consumer confidence gauge followed the sharp drop reported Friday in the reading from the University of Michigan consumer survey. Accordingly, Kathy Bostancik, chief US financial economist at Oxford Economics, said the decline in US consumer confidence was taking place at a time when consumer spending slowed from the massive gains seen in the first six months of the year. But many analysts said they still expect further gains in consumer spending in the coming months, given the high levels of savings that households currently enjoy.

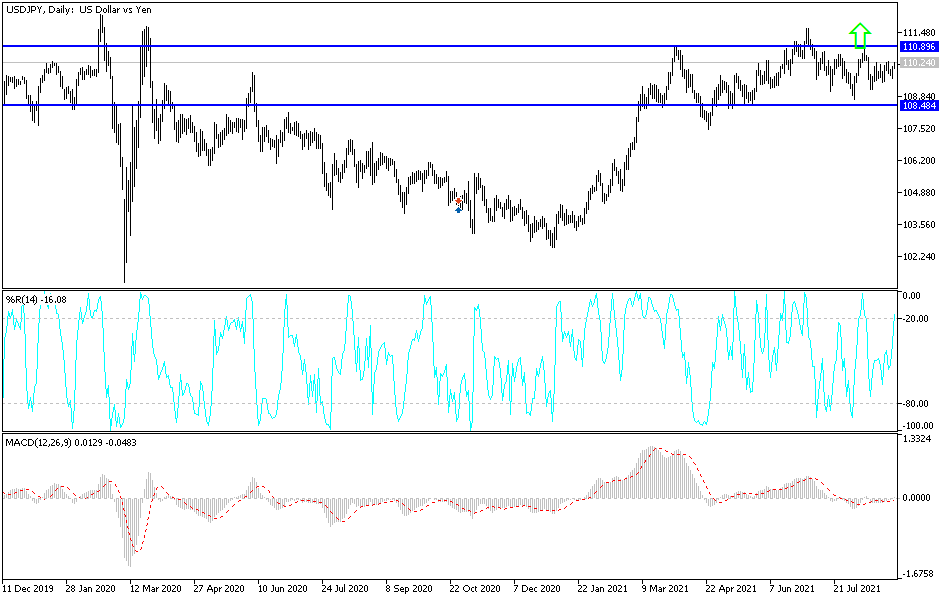

Technical analysis of the pair

A move above the 110.00 psychological resistance will support the bulls amid technical buying deals to move towards stronger highs, the closest of which are currently 110.65 and 111.20. On the other hand, bullish hopes will evaporate if the currency pair returns below the support level at 109.00. So far, I still prefer buying the currency pair from every descending level. It may remain moving in narrow ranges until the release of the US jobs numbers.