The US dollar is continuing to enjoy upward momentum amid expectations of raising US interest rates soon and investors abandoning the Japanese yen until the selection of the new Japanese prime minister. The USD is at its highest since COVID hit the scene in March 2020. The USD/JPY is stable around the 111.40 level as of this writing.

Former Japanese Foreign Minister Fumio Kishida has won the ruling party leadership election and is set to become Japan's next prime minister. Kishida replaces outgoing party leader Prime Minister Yoshihide Suga, who is stepping down after just one year since taking office last September. As the new leader of the LDP, Kishida is certain to elect the next prime minister on Monday in Parliament, with his party and coalition partner controlling the House of Representatives.

Kishida defeated Taro Kono, Minister of Vaccinations, in the run-off after leading over candidates Sana Takaishi and Seiko Noda in the first round. Japan's presumed next prime minister faces imminent and crucial tasks such as addressing the pandemic-stricken economy and ensuring a strong alliance with Washington amid rising regional security risks.

The new leader also needs to change the party's authoritarian reputation, which was exacerbated by outgoing Prime Minister Yoshihide Suga who angered the public over his handling of the coronavirus pandemic and his insistence on holding the Olympics in Tokyo last summer. Observers say the long-ruling conservative Liberal Democratic Party desperately needs to quickly circumvent waning popular support ahead of the upcoming House elections in two months.

The Federal Reserve has sent the clearest signals yet that the US central bank is close to starting to withdraw the unprecedented support it has provided to the US economy in the face of the effects of the COVID-19 pandemic. The Fed has indicated that it may start raising the benchmark interest rate sometime next year and is likely to start reducing the pace of its monthly bond purchases before the end of this year.

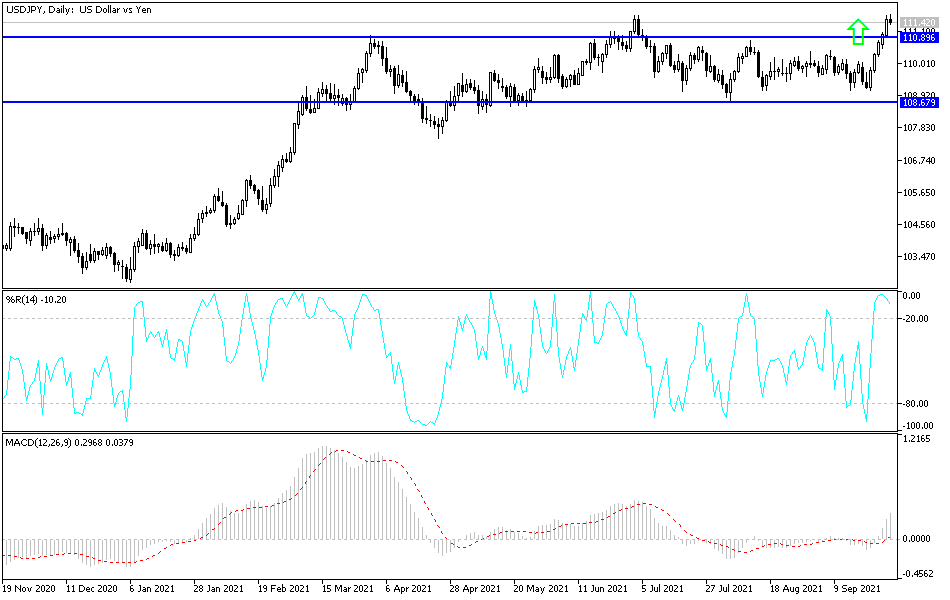

Technical analysis of the pair

I expect profit-taking selling after the recent strong and sharp gains of the USD/JPY currency pair, as it was enough to push the technical indicators towards overbought levels. The closest selling targets may be 110.90 and 110.00. The markets will continue to be affected by the extent of risk appetite, global anxiety over the energy crisis plaguing economies, as well as the path of the epidemic's outbreak with the advent of the winter season.

On the upside, the continued strength of the US dollar will not prevent the currency pair from testing the 112.20 resistance.

The US dollar will be affected today by new statements from US Federal Reserve Chairman Jerome Powell.