Despite the Federal Reserve's clear indications to tighten its monetary policy, the USD/JPY remained stable in a range between the 109.11 support and the 109.92 resistance, where it has settled as of this writing. The risk aversion in the markets increased the opportunity for the Japanese yen to hold on to its recent gains against the rest of the other major currencies. The Delta variant and the return of restrictions threaten the future of the global economic recovery.

Citing progress in achieving its goals of maximizing employment and stabilizing prices, the US Federal Reserve yesterday hinted that a curtailment of the US central bank's asset purchases could begin in the near future. Therefore, the Fed, in announcing its latest monetary policy decision, said that “moderation in the pace of asset purchases may be warranted soon” if progress toward its dual objectives continues as expected.

The US central bank currently plans to continue its bond purchases at a rate of at least $120 billion per month, but the scaling is expected to begin later this year.

During his post-meeting press conference, Fed Chair Jerome Powell indicated that the central bank may start reducing its asset purchases as soon as its next meeting in early November. "Although no decisions were made, participants generally felt that as long as the recovery remains on track, a tapering process that ends in the middle of next year is likely to be appropriate," Powell stated.

Powell also said that more significant progress has been made regarding the Fed's inflation target, while "the test of additional substantive progress in employment is almost done."

Comments about curtailing asset purchases came when the Federal Reserve announced its widely expected decision to keep the target range for the federal funds rate at 0 to 0.25 percent. The bank also reiterated that it expects it will be appropriate to maintain this target range until labor market conditions reach levels consistent with maximum employment and inflation is on track to moderately above 2 percent for some time.

However, the latest forecast from the Federal Reserve showed that most officials now expect to raise interest rates next year compared to previous expectations calling for a first rate hike in 2023.

At the same time, Fed policy officials also revised the forecast for US GDP growth in 2021 to 5.9 percent from 7.0 percent, while the forecast for GDP growth in 2022 was revised upwards to 3.8 percent from 3.3 percent. . Core consumer price inflation is expected to reach 3.7 percent this year, compared to the 3.0 percent forecast in June. Price growth is expected to slow to 2.3 percent in 2022, still above the Fed's 2 percent target.

In its policy statement, the Fed described inflation as "high" but continued to attribute price growth to "transitional factors."

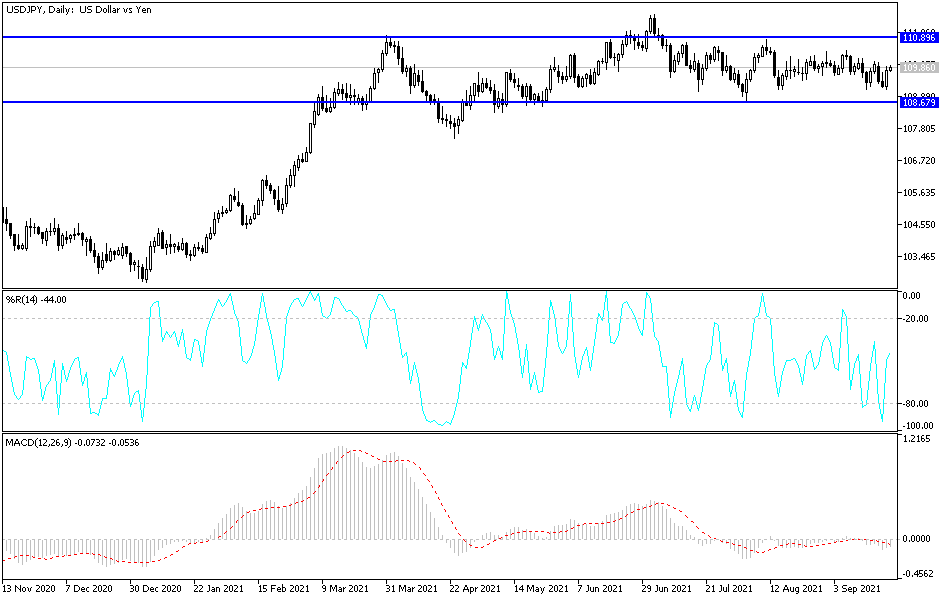

Technical analysis of the pair

On the daily chart, the attempts of the USD/JPY to breach the 110.00 psychological resistance are still weak, which encourages the bulls to buy. That may push the currency pair towards the resistance levels at 110.65 and 111.20, if investors regain risk appetite, which concerns about Chinese corporate debt and coronavirus variants have allayed. On the downside, the support levels 109.35 and 108.80 will remain crucial for the bears.

The currency pair will be affected today by risk appetite and the reaction from the weekly jobless claims and PMI readings for the manufacturing and services sectors.