For quite some time, the USD/JPY has been trying to break through the 110.00 resistance level, which is crucial for a bullish performance and to avoid a crash. The pair is making tight movements after the American holiday and in anticipation of the announcement of inflation and retail numbers in the United States of America. Most investors are sitting on the sidelines waiting to get a fuller understanding of where the US economy is heading and how the pandemic is affecting businesses.

"It's interesting that it's all still within that narrow range that we've seen in the markets," said Greg Psock, CEO of Axs Investments. "Investors continue to look to hang their hats on larger or more significant news related to the economic recovery."

Investors have been dealing with choppy trading for weeks as they try to assess how the economic recovery will move forward with rising COVID-19 cases hurting consumer spending and employment growth, while raising commodity prices. Wall Street is also closely watching how the Fed reacts to the changing pace of economic growth with its eventual plans to scale back support for low interest rates.

Analysts therefore believe that the major market players will continue to return to COVID-19, the Federal Reserve, and geopolitics in the near term to show mixed signals and this will create more uncertainty for investors. Wall Street will have several key pieces of data to review this week. The Labor Department will release its US Consumer Price Index for August on Tuesday, which will give investors another update on inflation as businesses and consumers face higher prices due to supply constraints.

The Commerce Department will release US retail sales data for August on Thursday to the market, which is still trying to determine the full impact of rising COVID-19 cases on consumer spending.

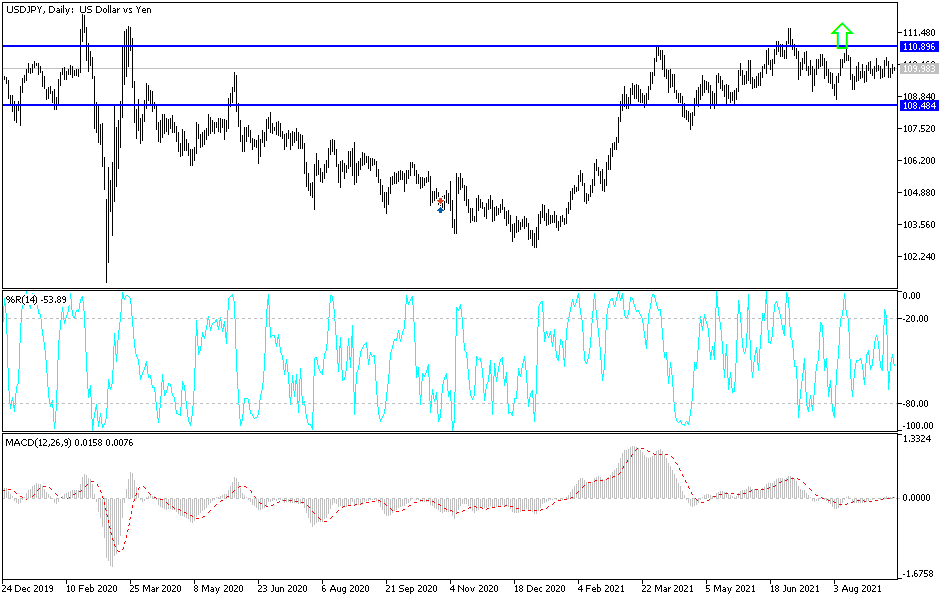

Technical analysis of the pair

With no change in performance, there is no change in expectations. As I mentioned before, the stability of the USD/JPY above the psychological resistance at 110.00 will remain a catalyst for the bulls to control the performance, thus increasing buys. The next resistance levels which will confirm the strength of the current trend are 110.65 and 111.20. The current bullish outlook may end if the bears return to the 109.35 and 108.80 support levels. I still prefer buying the currency pair from every dip.

The pair will be affected by risk appetite as well as the market reaction to the release of US inflation figures today. The policy of the Federal Reserve is determined by inflation and jobs figures in the country.