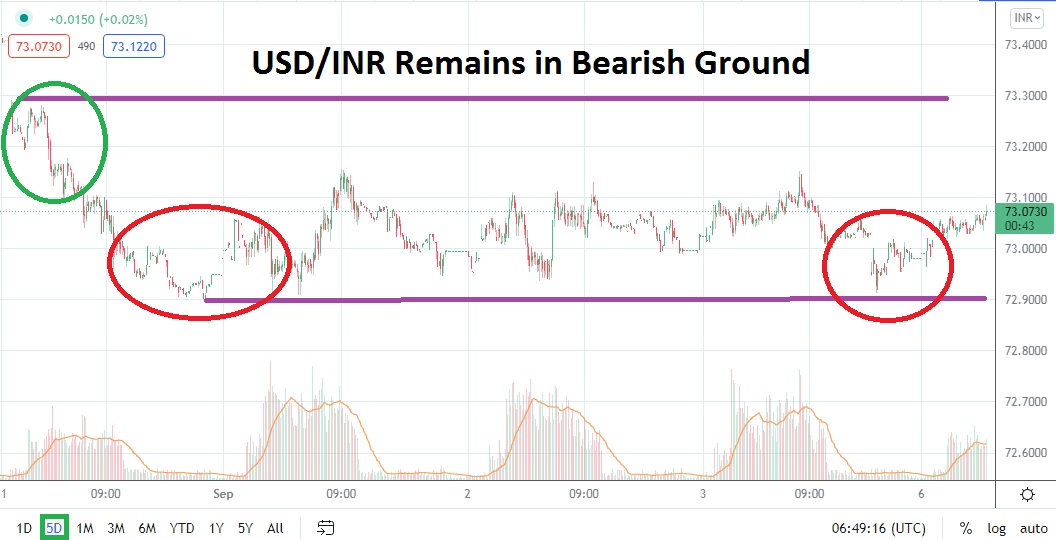

The USD/INR is trading above the 73.0000 level as of this writing and the Forex pair has climbed incrementally off the lows it achieved on the 31st of August. However, the slight moves higher since demonstrating the robust spike downwards from the 27th until the 31st of August have not been volatile and the USD/INR actually is maintaining its rather bearish stance efficiently.

On the 3rd of September, the USD/INR did climb to a high of nearly 73.1500, but this flourish of buying power was then greeted by a wave of selling which saw the Forex pair again traverse near the 72.9000 ratio. The 73.1000 mark may prove to be intriguing resistance in the short term, if this juncture proves durable and is not surpassed in a dramatic fashion it could signal additional selling action will develop.

The USD/INR certainly has produced a large move in the past couple of weeks and traders should be on the lookout for further volatility. It could be wishful thinking for another large and swift move to occur with a downward thrust near term. Traders are advised not to be overly ambitious with their price targets. In the short term, the support level for the USD/INR certainly appears to be near the 73.0300 to 73.0000 junctures. Speculators of the Indian rupee should probably anticipate short-term choppy trading results.

Transactional volumes in the USD/INR today are likely to be rather light since US financial institutions are celebrating a holiday, but this also opens the door for the potential of a large unbalanced order to shake the market without much notice. Traders should practice caution in the short term with the USD/INR, but if downside price action does develop another test of the 72.9500 to 72.9000 levels wouldn’t be a surprise.

Traders who continue to foster bearish sentiment regarding the USD/INR cannot be blamed. Cautious speculators may view reversals higher as potentially solid places to ignite selling positions when resistance ratios are challenged. If the USD/INR is adequately able to maintain the 73.1000 to 73.1200 levels as its high water marks in the short term, looking for moves downward with quick-hitting take-profit trades targeting close support is an intriguing speculative wager.

Indian Rupee Short-Term Outlook

Current Resistance: 73.1200

Current Support: 73.0300

High Target: 73.1900

Low Target: 72.9100