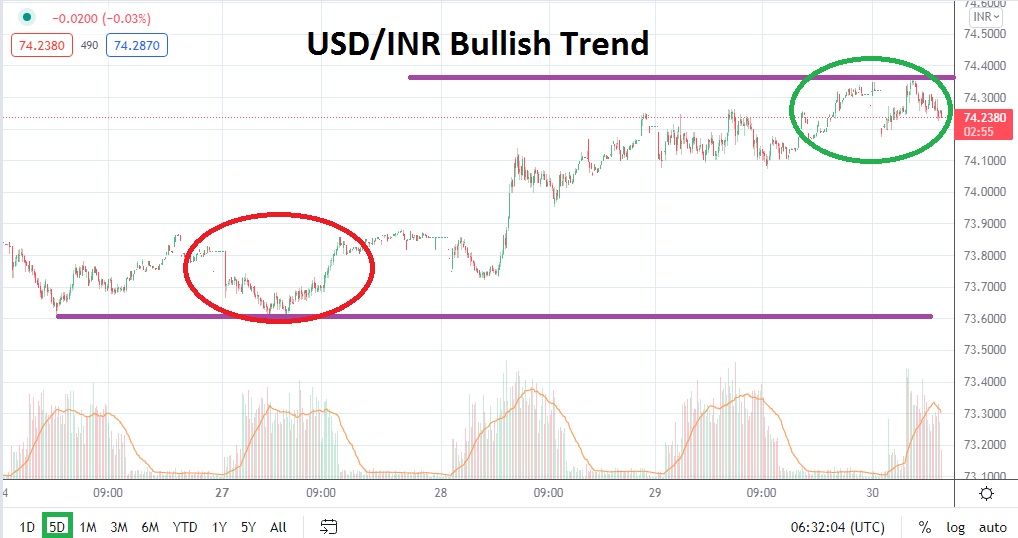

Having broken through the 74.0000 ratio in yesterday’s trading, the USD/INR has continued to find upwards momentum as bullish sentiment seemingly builds. As of this morning, the USD/INR is near the 74.2500 mark and traders should expect fast conditions to remain strong. The upwards trend of the USD/INR has been a dominant feature during the month of September, but the velocity of yesterday’s climb may have shocked even bullish speculators.

After achieving the rather demonstrative move higher, some speculators may be tempted to consider selling the USD/INR on the notion that reversals must naturally follow. While this may be a logical decision, traders who want to short the USD/INR at the current heights should probably use quick-hitting take profit targets that are not overly ambitious. While it makes plenty of sense to believe the 74.2000 mark will see some type of test when a reversal occurs, yesterday's and today’s price action also shows the upwards trend is strong and may continue to produce higher values.

Traders who have been pursuing the upwards trajectory of the USD/INR have likely found some profitable trading. However, now is not the time to believe that nothing wrong can happen; trading is a difficult task at all times and overconfidence can kill a trading account quickly if aggressive positions are undertaken without the use of proper risk management.

The USD/INR is now challenging early August highs and the resistance level of 74.3000 appears to be the next hurdle the pair will have to confront. If trading values remain near the 74.2500 ratio this morning and are sustained, this may be looked at in a positive light by bullish speculators from a technical perspective. Consolidation slightly below mid-term highs may signal another move higher, particularly if current support levels are sustained.

Buying the USD/INR on slight moves lower may prove to be a worthwhile wager when looking for another move higher in the Forex pair. If support near the 74.2100 to 74.1800 junctures proves to be strong, traders may want to target the 74.2800 to 74.3000 junctures with quick hitting speculative positions. Traders are cautioned not to become overly ambitious while pursuing upwards momentum. However, the recent price action of the USD/INR from a technical perspective suggests the bullish trend may not be over quite yet.

Indian Rupee Short-Term Outlook

Current Resistance: 74.3000

Current Support: 74.1800

High Target: 74.6700

Low Target: 73.9500