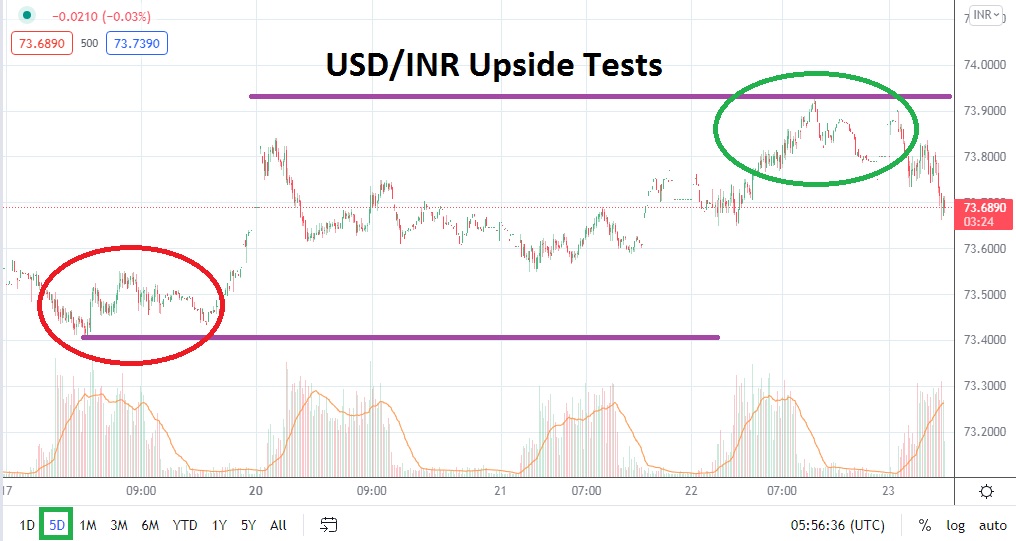

The USD/INR climbed to a high of nearly 73. 9350 yesterday as the Forex pair continued to challenge mid-term resistance levels. The high water mark achieved yesterday was last traded on the 27th of August, but this occurred as the USD/INR was coming off highs that had been trading near 74.3000 on the 25th of August.

By the 31st of August, the USD/INR was trading at nearly 72.9000, which highlights the ability of the Forex pair to move swift when sentiment changes. Technically, the choppy conditions dominating the USD/INR are occurring still within the middle of the long-term range, but perceptions for short-term traders may be causing anxiousness as they try to determine the next wave of direction. The global financial markets are experiencing a huge amount of ‘noise’ currently, so technical traders may have an advantage if they can eliminate the blare from media ‘talking heads’.

The USD/INR remains under important resistance psychologically and having attained yesterday’s high of nearly 73.9350, the ensuing reversal was intriguing. Traders are advised to continue to use quick-hitting take profit orders to capitalize on moves which go their chosen direction. While higher values which are being targeted by bullish speculators may look tantalizing, the inability of the USD/INR to actually test the 74.0000 juncture yesterday underscores why traders should not become too greedy.

A low of 72.6600 was seen early this morning in the USD/INR and this took place after financial institutions had reacted to the U.S Federal Reserve’s FOMC Statement. However, after hitting this morning’s lower depth, interestingly, the USD/INR managed to once again reverse higher and, as of this writing, the 73.7400 level is being flirted with. Resistance and support levels have actually grown tighter in the past twelve hours, but if the 73.8000 mark is penetrated higher, it may signal that additional buying momentum could develop.

Conservative traders of the USD/INR, who are anticipating more upside action, may want to go long when slight reversals are produced. Buying the USD/INR near the 73.7000 might be appropriate for cautious traders, but they may need a lot of patience if current values do not slip to these depths for a while. From a speculative technical viewpoint, it appears the USD/INR is continuing to indicate a tendency to incrementally creep higher.

Indian Rupee Short-Term Outlook

Current Resistance: 73.8100

Current Support: 73.6600

High Target: 73.9500

Low Target: 73.5500