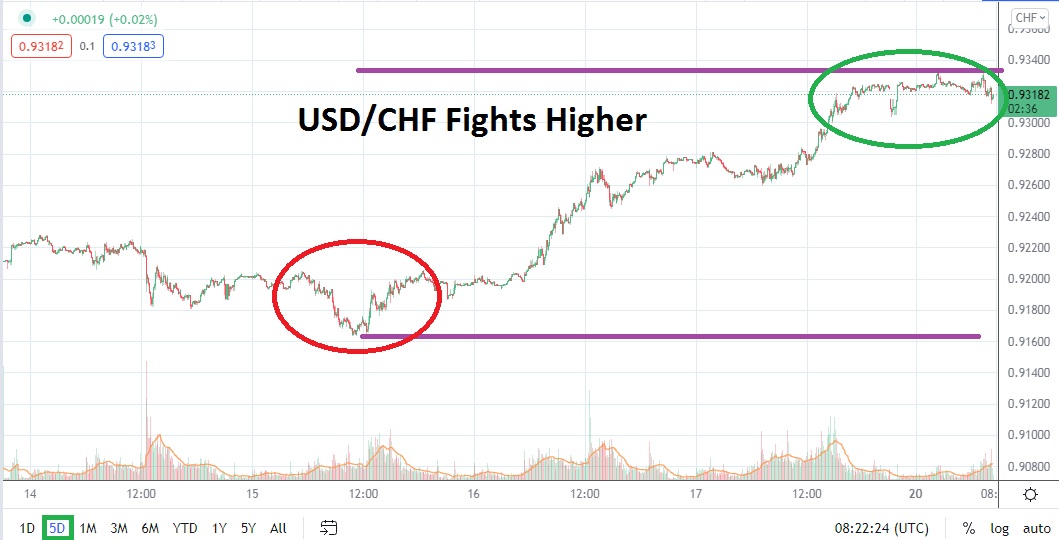

As of this writing, the USD/CHF is trading above the 0.93150 price rather comfortably. On the 3rd of September, the USD/CHF was near the 0.91100 mark, but had started to experience a slight incremental climb since the 16th of August. Technically, the USD/CHF has been choppy over the mid-term depending on trading perspectives, but as of today the Forex pair is certainly within sight of important resistance levels not tested since March and into the first week of April.

Technically, the USD/CHF has certainly been able to brush aside short-term resistance levels since early last week. This has developed on the heels of growing nervousness in financial institutions regarding global equity indices. Early calls on US future markets point to a sharp selloff when the day begins on Wall Street, and already in Europe strong selling has been experienced within equities.

Technically, if the USD/CHF is able to sustain its value above the 0.93100 level and begin to put in a challenge to the 0.932000 juncture, this could be an indication that short-term buying momentum may develop another leg up. A high of nearly 0.93330 was registered early this morning before a reversal lower, which last saw this value on the 6th of April. Bullish speculators within the USD/CHF may want to note that the Forex pair traded within the 0.93750 to 0.94440 range with a few outliers from the 24th of March until the 5th of April.

The USD/CHF is frequently projected as a consolidated trade when it is discussed by some analysts but it actually provides a rather robust amount of volatility for speculators. Depending on the amount of leverage used within trading parameters, the USD/CHF can deliver a considerable punch if positions are too speculative and correct tactics are not used.

The USD/CHF is within the upper realms of its bullish momentum. Certainly short-term highs are being targeted, but now might not be the time to fight against the emerging trend within the Forex pair. Speculators who have the ability to buy the USD/CHF on momentum wagers might want to wait for the USD/CHF to surpass the 0.932000 ratio first before going long with conservative viewpoints. More aggressive traders may be willing to buy the USD/CHF on slight reversals lower that come within sight of the 0.93130 to 0.93100 marks and wager on long positions.

Swiss Franc Short-Term Outlook

Current Resistance: 0.93380

Current Support: 0.93070

High Target: 0.93680

Low Target: 0.92780