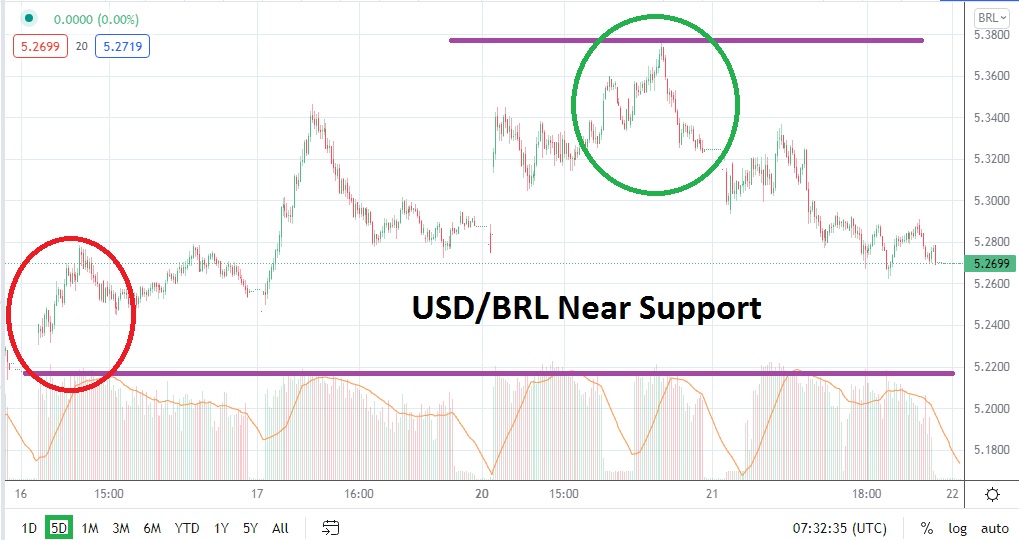

The USD/BRL finished trading yesterday slightly below the 5.2700 level. Speculators should keep their eyes on the opening and monitor early direction. Having attained a high yesterday of almost 5.3800 and then producing a sharp reversal lower, the USD/BRL delivered a considerable amount of short-term volatility. The last time the USD/BRL traversed yesterday’s heights was on the 24th of August, after reaching an apex of approximately 5.4700 on the 20th of the same month.

Intriguingly, while the USD/BRL reversed lower after the strong bullish move upwards, the USD/BRL finished near support it last touched on the 17th of September. A low of nearly 5.2500 was seen on the 17th, which might create the perception that if bearish sentiment is still tangible in early trading today, the USD/BRL could try to approach this level. However, if the 5.2650 juncture proves adequate early today and the value of the Forex pair is sustained above, this might be a signal that additional upside will develop.

Since reaching a low of 5.1100 on the 31st of August, the USD/BRL has incrementally added value as a bullish trend has developed. The price action of the USD/BRL demonstrated that speculators need to be on the lookout for additional volatility in the short term. Global market nervousness is having an effect on financial institutions and if sentiment remains fragile, the USD/BRL is likely to react with sudden gyrations.

The USD/BRL has proven in September that the 5.3000 juncture is not immune to being brushed aside when it appears to be resistance. On the 8th, 9th and 17th of this month, prior to yesterday’s high water mark, the USD/BRL has progressively tested a bullish trajectory. If nearby resistance of 5.2850 is surpassed easily today it could mean that another test of the 5.3000 juncture may ensue sooner rather than later.

Speculators with bullish sentiment may look at the current level of the USD/BRL as a potential buying opportunity. If current support levels remain adequate and the 5.2675 to 5.2650 ratios remain strong, this could be mean a reversal higher may develop. Traders looking to buy the USD/BRL on slight moves lower and igniting bullish positions seeking quick hitting targets higher cannot be faulted for their speculative wagers.

Brazilian Real Short-Term Outlook

Current Resistance: 5.2850

Current Support: 5.2620

High Target: 5.2990

Low Target: 5.2490