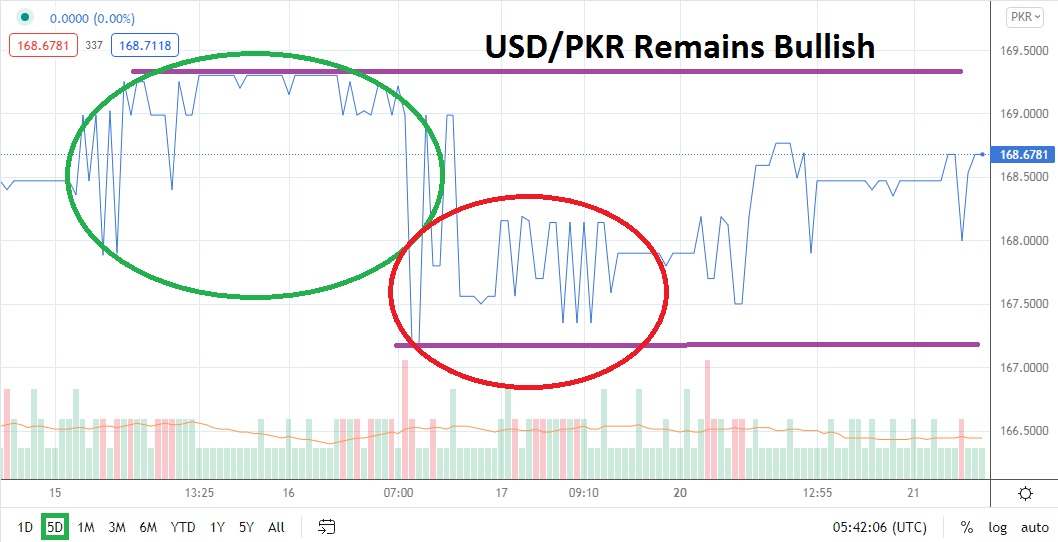

The USD/PKR remains within the boundaries of its record highs and this is unlikely to change anytime soon. As of this writing the USD/PKR is trading below the 169.0000 juncture, but from the 15th through the 16th of September the forex pair tested the 169.3000 level. Yes, the USD/PKR has suffered a slight reversal lower, but the decline did not break any major trends and speculators cannot be blamed for wanting to pursue upwards price action.

Certainly the USD/PKR can decline and traders who want to pursue the forex pair are reminded to not bet their life savings. Traders need to understand the USD/PKR doesn’t have a gigantic amount of volume and that large transactions by the Pakistan government and the occasional financial institution can create unexpected moves. Speculators need to use entry point orders when wagering on the USD/PRK so they do not receive unanticipated price fills which can make their pursuit of a target more difficult.

Technically the USD/PKR is clearly within the midst of another bullish run. Since the 11th of May the USD/PKR has gone from a low of nearly 151.8000 and incrementally added value on a consistent basis. The trend doesn’t appear ready to stop quite yet. Besides the technical aspects of the USD/PKR which seemingly watches resistance brushed aside on a rather steady timeline, fundamentals are also playing a role in the bullish momentum of the forex pair.

Besides suffering from a rather troubling economic situation, Pakistan also may be confronted now with the prospect of a knock on effect from potential concerns growing in China financially. The short term looks to be worrisome and this may create tension for financial institutions as they try to create a safe haven for their transactions, which means buying the USD/PKR in order to hold USD instead of PKR.

The target of 169.0000 as resistance looks to be an attractive for speculators who can hold the USD/PKR and withstand overnight carrying charges. If a speculator can place a wide stop loss, manage their leverage effectively and not be killed on transaction fees, going long the USD/PKR remains the worthwhile wager for traders who have the desire and capability to pursue the rather ‘exotic’ forex pair. Buying the USD/PKR below 169.0000 with entry orders and looking for more bullish price action seems to be a logical endeavor.

Pakistani Rupee Short Term Outlook:

Current Resistance: 169.0000

Current Support: 168.4000

High Target: 169.4000

Low Target: 168.0000