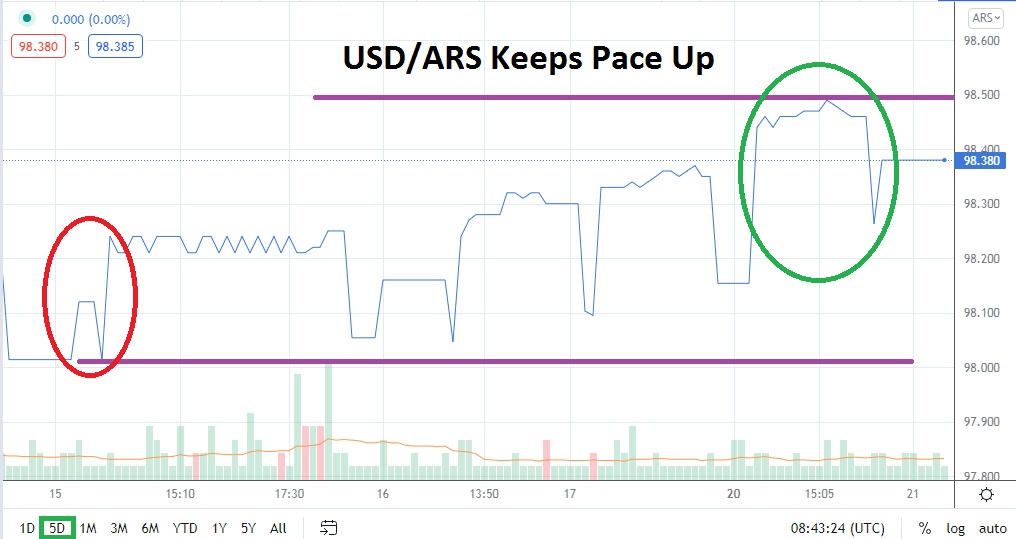

Political infighting among the ruling party in Argentina due to a fight over minister positions and terrible economic policy has helped the USD/ARS establish new highs. The USD/ARS is now traversing comfortably above the 98.300 level and demonstrated an apex of nearly 98.500 yesterday which now functions as a potential resistance level for speculators.

There is little doubt the USD/ARS will continue on its bullish path higher. Argentina is mired within a political abandonment concerning economic reality. The reshuffle of ministers to the ruling Peronist party in the past few days has come about because the leader Alberto Fernandez is vulnerable. While his economic policies have been a disaster, the woman calling the shots from behind the scenes, Christina Fernandez de Kirchner, appears to have little interest in anything else but trying to appease potential voters.

As she works hard to placate her voting base and essentially governs behind the curtain, she is clamoring for less fiscal management and greater spending by the government which is already heavily in debt. Fernandez de Kirchner likely fears a voter repercussion in November via Argentina’s mid-term elections which could cause a shift and see her Peronist party lose a lot of their power.

The combination of bad economic policy now, and a political vacuum potentially about to take place in November is certainly not helping the USD/ARS. Technically the USD/ARS is a buy, fundamentally the USD/ARS is a buy – can this be written any clearer? The problem for speculators is that they need to avoid expensive transaction fees, be patient enough to endure possible overnight positions, make sure their price fills are realistic and use stop losses to protect against the occasional reversal. There are no guarantees for speculators buying the USD/ARS, but it is more a question about trading tactics compared to the potential direction of the Argentine peso that is in concerning.

Resistance near the 98.500 level is a legitimate target near term for traders. Support near the 98.300 may prove to be strong. Traders who can use a conservative amount of leverage and wider stop loss ratios may find the best results. Speculators who are buyer should not be overly ambitious and be willing to cash out winning wagers when they emerge too. Buying the USD/ARS remains the logical choice, patience is a key and solid risk management is a must. The steady march of the USD/ARS remains an unwavering parade.

Argentine Peso Short Term Outlook:

Current Resistance: 98.500

Current Support: 98.300

High Target: 98.600

Low Target: 98.150