The S&P 500 fluctuated on Friday as we continue to hang about the 4500 level. The jobs number did nothing to help the situation, as the United States came short about 500,000 jobs compared to the expected number. With that being the case, I think traders are again starting to look at the idea of Federal Reserve liquidity measures running forever.

Keep in mind that the Monday session will be electronic only, as the Labor Day holiday will have the actual market itself closed. With this, we are in an uptrend and essentially spent the entire week sideways. This makes a lot of sense that we did nothing, due to the fact that it is also one of the most common vacation weeks for traders and liquidity may have been just a little bit of an issue as nobody was involved.

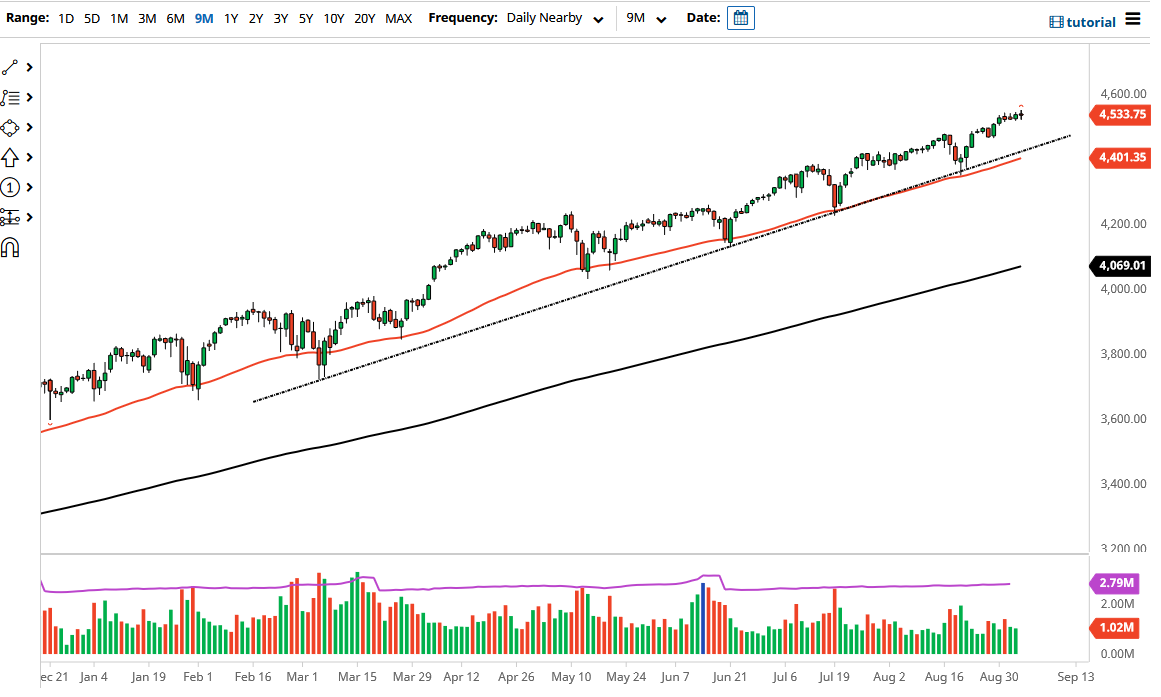

I anticipate that you will probably get more clarity on Wednesday, because Tuesday might be a lot of position putting on as we start the next quarter and money starts to go back to work for the month. Regardless, I think any dip offers value, and the uptrend line together with the 50-day EMA continues to offer significant support. When you look at that recent past, you can see that every time we have touched those things, we bounced. I see no reason to see why that would change anytime soon, as we are simply drifting higher. Whether or not we get any real momentum might be a different question, but I think eventually we willl go looking towards the 4600 level.

If we break down below the uptrend line and the 50-day EMA, much like with the NASDAQ 100 I would not be a short seller, but I might buy puts just in case we do get something going to the downside. Regardless, if we break down from here towards the 4000 level, then the Federal Reserve will get involved due to the fact that it is a 10% loss, something that Wall Street simply will not tolerate. I think we are much more likely to see dips get bought going forward, as people are going to start to question if the Federal Reserve can even taper between now and the end of the year. If they do, it does not matter because interest rates will remain low regardless.