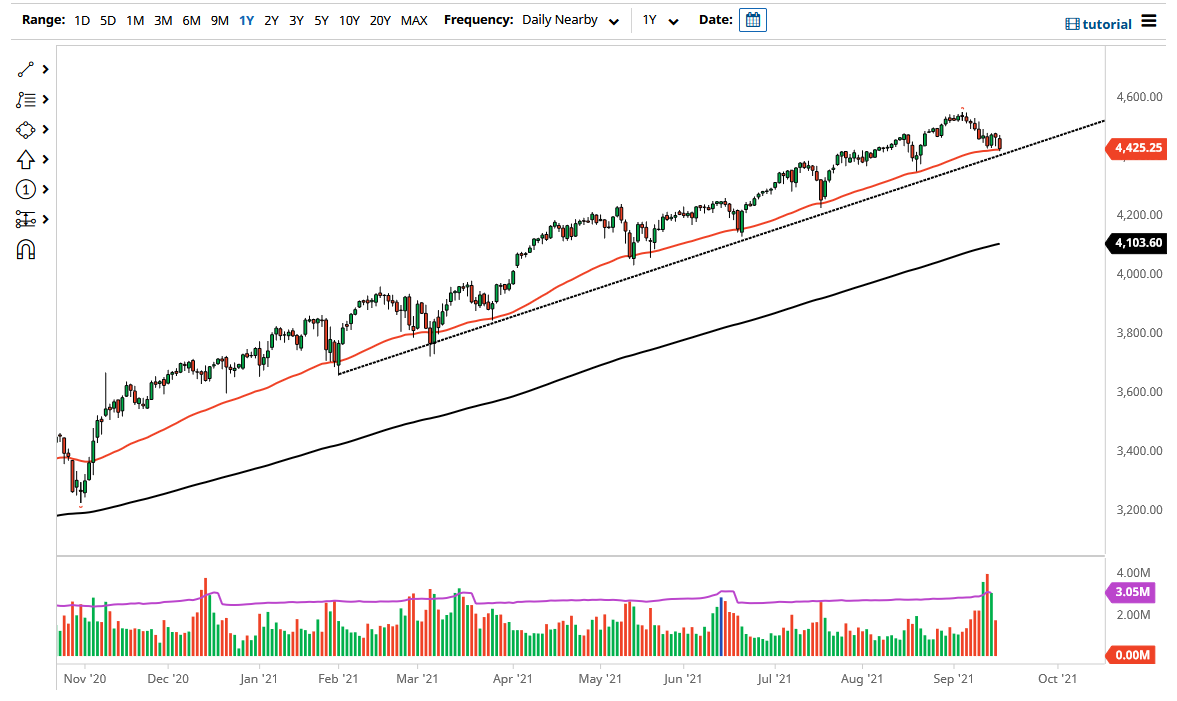

The S&P 500 fell a bit on Friday as the quad witching came and went. The 50-day EMA is offering a significant amount of support, sitting at the 4425 handle. The uptrend line sits just below and offers a lot of support, and I think that we are ready to see buyers jump back into this market.

If we were to break down below the uptrend line and the 50-day EMA, then I would be a buyer of puts as I think we will probably go looking towards the 4200 level. The 4200 level is an area that will attract the 200-day EMA, and that could be the bottom of the market. This suggests that we can even break down, because it seems quite astonishing that no matter what happens, there is a narrative to have traders coming in to pick up the market.

While I would normally be concerned about the market right away due to the fact that we closed at the bottom of the range, the fact that it was quad witching probably has a lot to do with what is going on. That being said, if we were to turn around and break above the highs of the Thursday session, then it is likely we could go higher. This is what would be expected from the longer-term traders, and a lot of people are starting to look towards the end of the year with positivity, although recently we have seen a lot of noise due to the fact that tapering from the Federal Reserve is anticipated.

Ironically, one of the biggest problems for the market this week was the fact that retail sales were much stronger than anticipated, showing that fundamentals do not have a whole lot to do with what goes on initially; it is all about monetary flow coming out of the Federal Reserve. If retail sales continue to strengthen, the idea is that the Federal Reserve will have to tighten or at least taper much quicker than anticipated. That is probably nonsense, but at the end of the day that is what has been driving the market recently, and I think that will continue to be the noise we have to deal with.