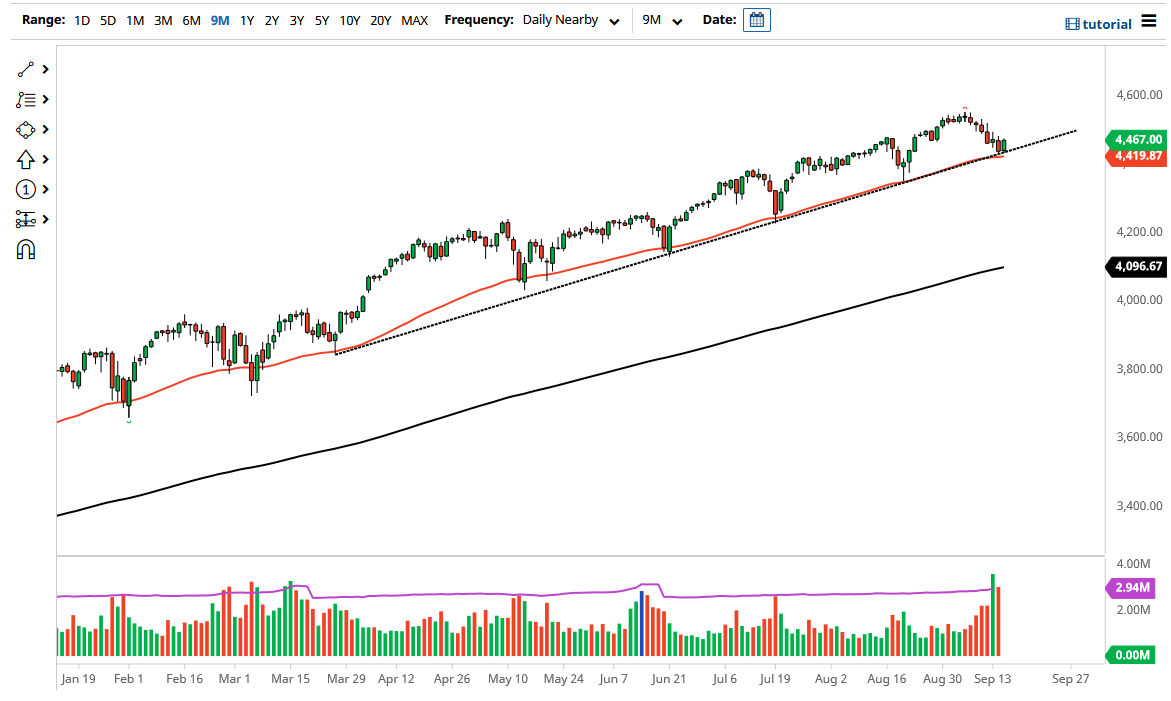

The S&P 500 has rallied significantly during the course of the trading session on Wednesday to wipe out the losses of the Tuesday session. The uptrend line continues to offer significant support, right along with the 50 day EMA. With that, it is likely that the market continues to go much higher. The market has been in an uptrend for so long that it is difficult to imagine a scenario where we could sell this market. In fact, the only thing that I can do is be a buyer of puts if we break down below the 4400 level. That is as bearish as I get in this type of manipulated market.

To the upside, the 4500 level is a large figure that we have to pay close attention to. The 4500 level is an area that would attract a lot of attention, but quite frankly we have already sliced through it, so I do not see where the market would pay a huge amount of attention to it. In fact, I think it is more likely that if we reach that area, we break through it to go looking towards the 4600 level, as the market tends to move in 200 point increments. That has been the case for a while, so I just do not see how that changes anytime soon.

The market has been very negative recently, but quite frankly the way that we have performed during the day on Wednesday does suggest that we might be continuing to hang on to the overall uptrend channel. As long as that is the case, the market is likely to continue in the same pattern and we may have seen the worst of the selling up to this point. The market continues to see plenty of reasons go higher, not the least of which would be the Federal Reserve. Furthermore, as long as monetary policy continues to be loose, it is difficult to imagine a scenario where the money goes flowing into the stock market because quite frankly there is nothing else to do at this point. You cannot earn yield from bond markets, so money goes looking towards equity instead. The next couple of days should give us a bit of a heads up as to where we go over the longer term but clearly something has changed again on Wednesday.