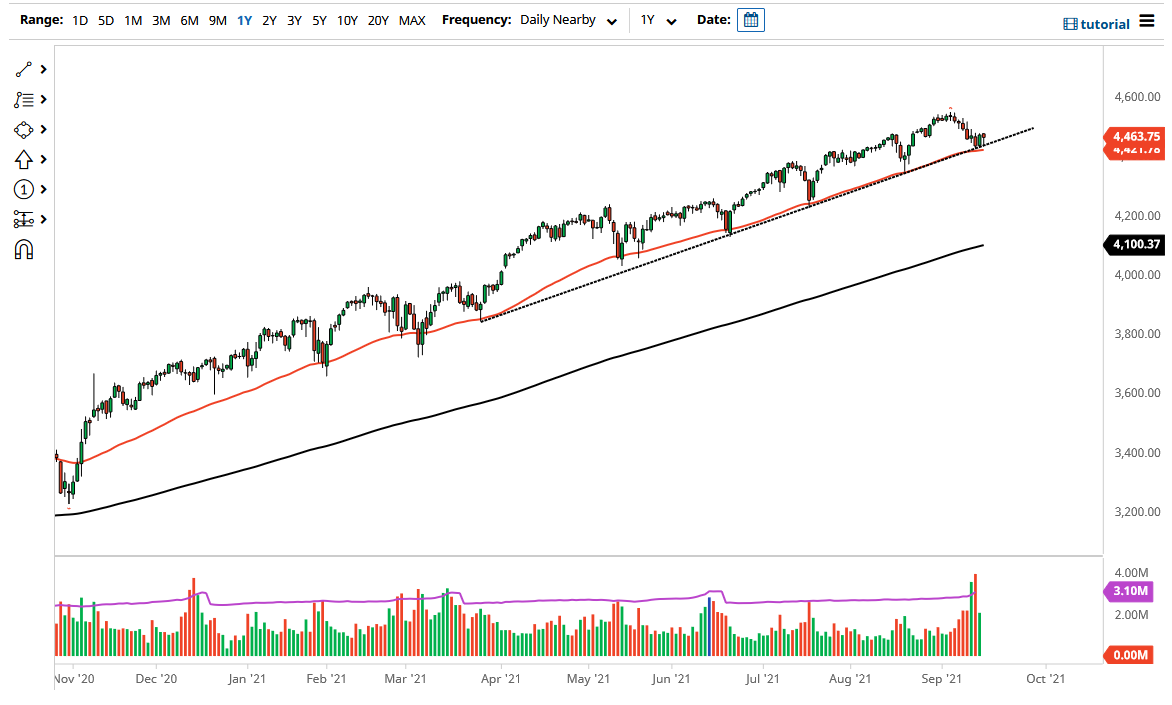

The S&P 500 has pulled back during the trading session on Thursday, but then turned around to show signs of strength again as we ended up forming a hammer. The fact that we gave back most of the gains to slam into the uptrend line and then turned around suggest that we are going to continue the overall uptrend.

The uptrend line is also backed up by the 50 day EMA, so that of course shows quite a bit of interest by traders. We have seen the 50 day EMA offer support multiple times, and the market is obviously paying close attention to this level. The market breaking down below the 50 day EMA could open up fresh selling to reach towards the 4400 level, which has been important more than once. The market seems to react to it as you can see on the chart. The uptrend line and the 50 day EMA all have been relatively reliable, and until we break down below them both, you have to assume that the market traders will continue to look at them as such.

If we do break down below these areas though, I might be a buyer of puts. That is as aggressive as I get to the downside in a market that is so highly manipulated by the central bank. The Federal Reserve does not necessarily come straight into the market and start buying but will do things such as jumping into the bond markets and jawboning on new shows in order to push the market back to the upside. Looking at this chart, you can see that we have been steady for a while, and I do not see that changing anytime soon.

To the upside, the 4600 level would be a target, but I think you should continue to look at this through the prism of every 200 points, as the 200 points interval seems to be attracted to this market. I think this is a market that continues to be noisy but still positive overall. Quite frankly, if we were going to break down it is likely that it would happen in this area, as we are sitting on such a major confluence of support. That being said, I would anticipate that it is very noisy to say the least going forward.