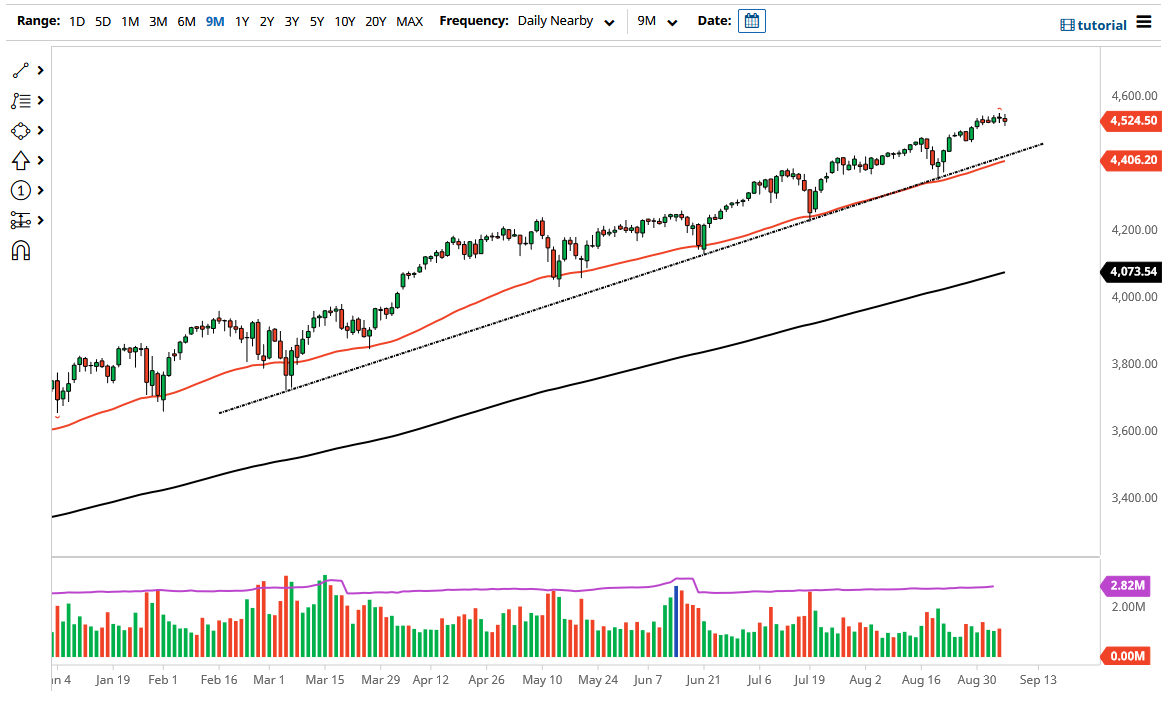

The S&P 500 went back and forth during the trading session on Tuesday as traders seem to be a little lost as to where they wanted to be. Nonetheless, this is a market that I think will eventually show plenty of resiliency, and even though we are looking for a little bit “flat” at the moment, I think it is only a matter of time before we see buyers come back in and pick up any dip that occurs. In fact, the 4500 level underneath should continue to be very resistive, so if we were to break down to that area, I would anticipate that there should be plenty of buyers.

Underneath I believe that this is a market going to continue to find plenty of support at the uptrend line and of course the 50 day EMA. Ultimately, this is a market that I think will continue to attract plenty of buyers on dips, as they are trained by the Federal Reserve to buying dips. The Federal Reserve will do everything it can to bail out Wall Street at any turn, so I simply do not short any of the US indices. With that, if we were to break down below the 50 day EMA, I might be a buyer of puts, but that would be a short-term trade more than anything else. I would not get overly short the NASDAQ 100, S&P 500, or anything else that is traded in New York City.

To the upside, if we break above the highs from the last couple of candlesticks, then it is likely that we are going to go looking towards the 4600 level. The 4600 level is another round figure that a lot of people will be paying close attention to, as the market tends to move in 200 point increments. With this, I think that the market will find a reason to get there, and then perhaps even higher than that. In general, this is a market that I think you can only be long of, or on the sidelines. Right now, it is probably a good time to be on the sidelines. One of the biggest mistakes I have ever made is trying to short this thing naked, something that you just simply cannot do as long as the Federal Reserve is going to ease monetary policy at the first hint of trouble.