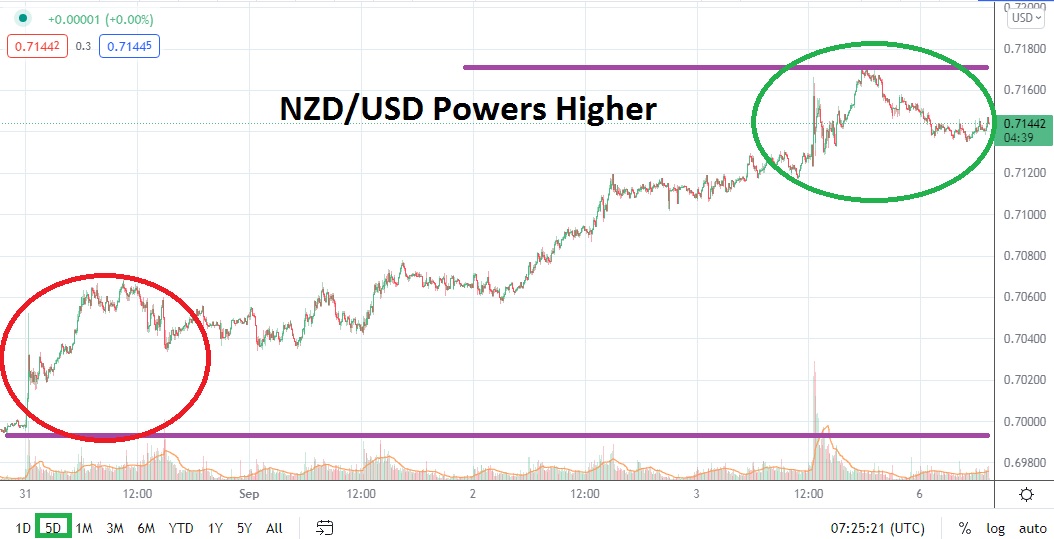

The NZD/USD is trading slightly below its short-term highs, which also happens to be within shouting distance of important mid-term values. On the 28th of August the NZD/USD was trading near the 0.68000 vicinity and its ability since this date to currently be traversing above the 0.71000 juncture with a healthy dose of mobility is rather remarkable. However, traders of the NZD/USD with experience are likely accustomed to these types of adventures within the Forex pair.

As of this writing, the NZD/USD is near the 0.71400 mark, which is within shouting distance of highs seen on the 3rd of September when the Forex pair touched the 0.71700 vicinity. The fact that the NZD/USD didn’t surge towards the 0.72000 in a quick heartbeat may actually be a positive sign for bullish traders, perhaps proving that the Forex results weren’t over exuberant. The last time the NZD/USD traversed these heights was in the second week of June.

Intriguingly, from a technical viewpoint, the 0.71700 level appears to be interesting resistance. If it is punctured higher this could represent a gateway towards a price range traded with sustained force from the second week of April until the second week of June. The price range during that stretch of time consistently tested marks between the 0.71600 to 0.72800 junctures.

The speculative flavor of these higher values may have traders anticipating another bullish surge short term. While this may be proven to be correct, traders are also urged to be somewhat cautious near term, the move higher within the NZD/USD has certainly been strong, but being overly ambitious can lead to mistakes when trading. Speculators with loftier price ratios in mind should also consider that a volatile move downwards can cause ‘virtual’ profits in trading accounts to vanish quickly if they are not cashed in.

Yes, the NZD/USD does have the potential to trend in rather strong moves and that has been demonstrated the past week-and-a-half of trading. Speculative buying remains the logical calling card for the NZD/USD short term, but cautious traders may want to wait for slight reversals lower. Support for the NZD/USD appears to be the 0.71250 to 0.71170 ratios. If these marks prove adequate and values are sustained above, going long the NZD/USD near term may prove to be a worthwhile wager.

NZD/USD Short-Term Outlook

Current Resistance: 0.71600

Current Support: 0.71250

High Target: 0.71950

Low Target: 0.70780