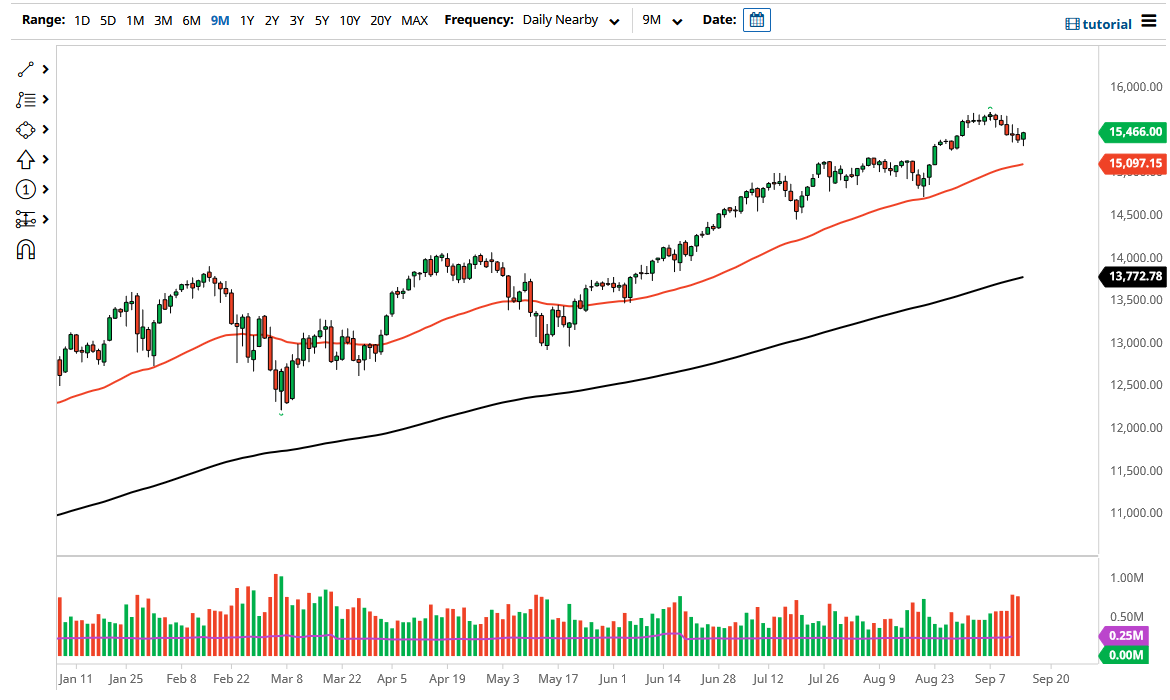

The NASDAQ 100 initially fell during the trading session on Wednesday to reach down towards the 15,300 level before turning around and showing signs of strength again. In fact, we started to close towards the top of the overall range, so it does suggest that the market is likely to continue the overall uptrend. That being said, the market is very volatile these days so do not be surprised at all to see a lot of choppy behavior in a back-and-forth type of attitude.

You should also be cautious about the fact that the markets have a lot of noise attached to them, as traders are trying to figure out where inflation and the economy overall is going. The market is likely to continue looking at the NASDAQ through the prism of growth companies, as the major players such as Facebook, Amazon, and Tesla all continue to drive the narrative. As long that is going to be the case, I think it is only a matter of time before those handful of companies come back into vogue, because quite frankly that is what Wall Street does. They simply buy the stocks every time the dip appears.

If interest rates continue to shrink, that also drives these stocks higher, as there is no other alternative due to the fact that there is almost no yield to be had in the bond markets. Because of this, I think that what we are looking at is a scenario where the 50 day EMA underneath continues offer massive support, especially as it sits just above the 15,000 level, an area that is important in general. Breaking down below that would of course signify something even more meaningful when it comes to negativity, but at that point I would be a buyer of puts, not trying to short this market straight out.

As things stand right now though, it certainly looks as if we are going to try to continue to go higher, so paying attention to the momentum is the best way to go. It is probably only a matter of time before we get back to the all-time highs, but that being said it is also a very choppy and noisy market overall. As long as we stay above the 50 day EMA, I am bullish of this market but also recognize that we continue to see a lot of noisy pullbacks.