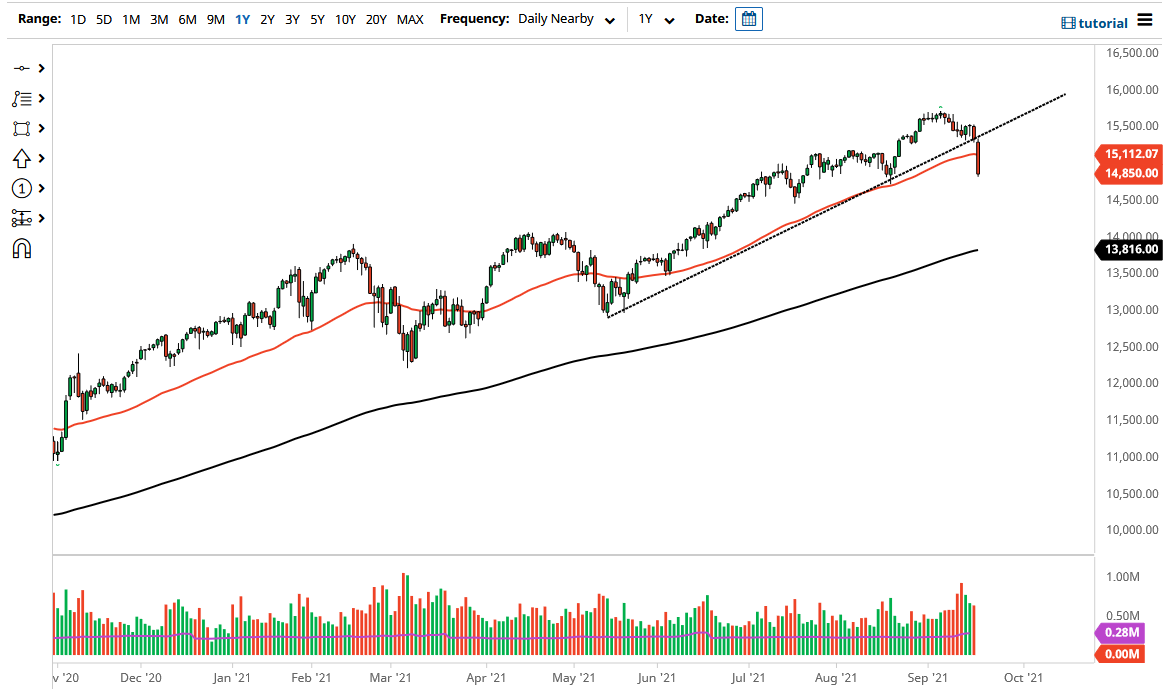

The NASDAQ 100 has broken down significantly during the course of the trading session on Monday, to slice through the 50 day EMA and approached the 14,800 region. If we break down below that level, then it is likely that we go looking towards the 14,500 level again. The 50 day EMA been sliced through of course is a negative turn of events, and you should also pay close attention to the fact that we have sliced through a major uptrend line. With that being the case, we probably have some follow-through ready to happen, and that could be a sign that we are getting ready to go much lower.

At this point, I am a buyer of puts but I would not be short of this market. The 200 day EMA sits just below the 14,000 level, which of course is a large, round, psychologically significant figure. All things being equal, this is a market that continues to see a lot of interest in that area from what I can see, so I do believe it is only a matter of time before we get down there. On the other hand, if we break down below there then it is likely that the market goes looking towards the 13,000 handle. The shape of the candlestick certainly looks as if it is ready for the market to break down quite drastically, and quite frankly we have needed to see this for a while.

The market is one that seems to be a major “buy on the dips” type of event regardless of what happens, but I think that will eventually find plenty of value hunters, but it may take a while to get there. The NASDAQ of course is driven by a handful of companies, so keep an eye on the usual “Wall Street darlings”, such as Facebook, Apple, and Tesla. If those markets all start to rise, that will by extension bring this market to higher levels. On the other hand, the search of the selloff is almost impossible for the NASDAQ 100 to continue going higher. This is the biggest problem with a “weighted-average” as it does not allow for the free flow of the index without interference. Furthermore, you have to keep in mind that the Federal Reserve will step in and pick this market up one way or another if we fall far enough.