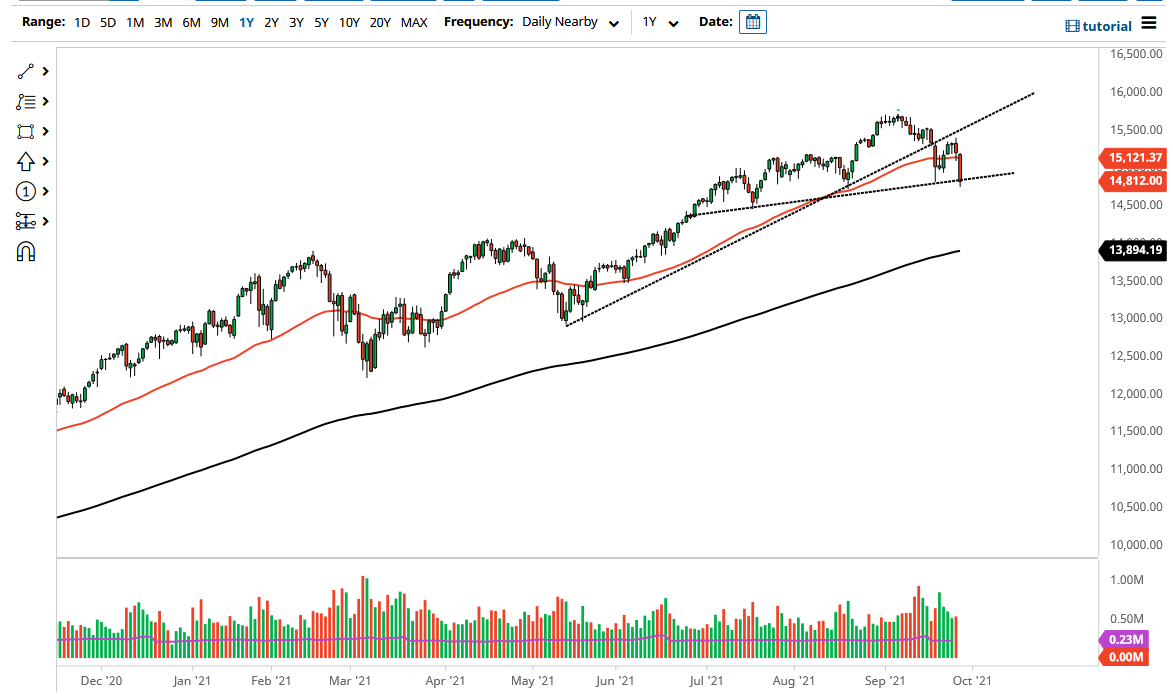

The NASDAQ 100 fell rather hard on Tuesday to reach down and break the bottom of the lows from last week. That is a very negative sign, but it looks like we have a little further to go. Keep in mind that the NASDAQ 100 is highly sensitive to risk appetite and, more importantly, the 10-year yield. If the 10-year yield rises too much, it makes the idea of growth stocks less attractive. However, if interest rates start to fall again, this is a market that will be favorable.

The 50-day EMA above has a certain amount of negativity attached to it, but we have sliced through a couple of times, so that does suggest that perhaps we have some work to do. If we turn around and break above the 50-day EMA, then the next target would be the 15,500 level, which would open up the possibility of a much bigger move. On the other hand, if we were to turn around and break down below the bottom of the candlestick for the trading session on Tuesday, that could open up fresh selling. This is a market that is going to continue to be very noisy and breaking down below the trend line could lead to a much bigger move.

The market has closed towards the bottom of the candlestick, so that is a sign that there might be a little bit of momentum. The market is going to continue to be very noisy, and at this point I would be very cautious about shorting this market but would be interested in buying puts if we break down even further. The 200-day EMA could be the target, but to actually short this market is going to be difficult as the Federal Reserve will do whatever it can to save Wall Street. With this being the case, we are still very much in an uptrend, but the question now is whether or not we will pull back in order to continue that uptrend, or if we will simply turn around and break out to the upside. I think at this point it is very unlikely that we will simply rip to the upside, and I anticipate that any move is going to be more or less a grind.