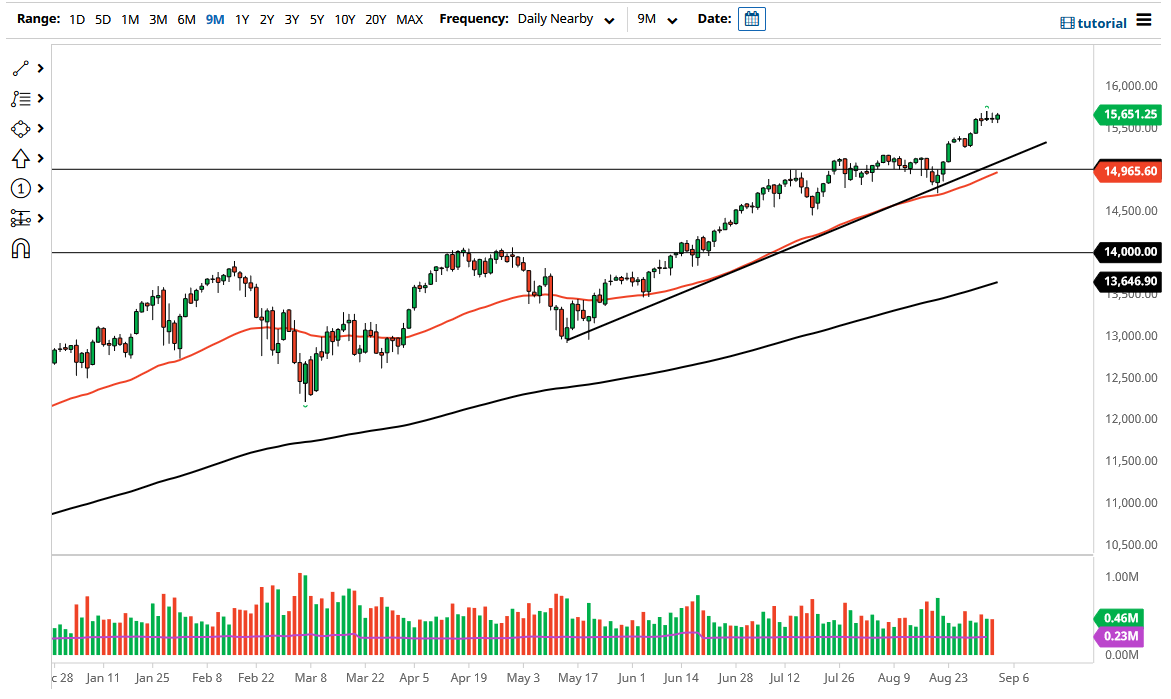

The NASDAQ 100 initially pulled back just a bit on Friday but then turned around to show signs of life again. After all, the market has seen the NASDAQ 100 try to break out multiple times last week, but unlike the previous sessions, the Friday session actually had a green candlestick. The highs from the Wednesday session being broken to the upside seems to be what the market wants to do, and if we get that, it is likely that the NASDAQ 100 will go looking towards the 16,000 level.

With that being said, I think that you need to keep in mind that the NASDAQ 100 is lifted by about seven stocks, all of the so-called “Wall Street darlings” such as Facebook, Microsoft, etc. With that being the case, as long as the major technology companies continue to attract inflows, then the NASDAQ 100 will more than likely go looking towards the upside.

That being said, the market is likely to have a lot of noisy trading going forward, and I think that the 15,500 level is probably going to continue to be supportive, so the fact that it sits just below also helps as well. With that being the case, I think all you can do is look to buy on dips. After that, then you have the uptrend line and the 50-day EMA as well as the 15,000 level. In other words, there is no way to short this market, so we will continue the same behavior that we have seen over the last 13 years, and the market simply shows signs of value hunting at all turns.

On the other hand, if we were to break down below the 15,000 level, I could be a buyer of puts, but that is as bearish as I get with this market as it tends to be heavily influenced by the Federal Reserve and just a handful of stocks. With this, I would not short this market, because the Federal Reserve will do whatever it can to protect Wall Street. I believe that we are much more likely to see 16,000 before we see 15,000, and I look at dips as a potential value play that a lot of people will be looking towards. Furthermore, the fact that we closed higher on Friday does suggest things.