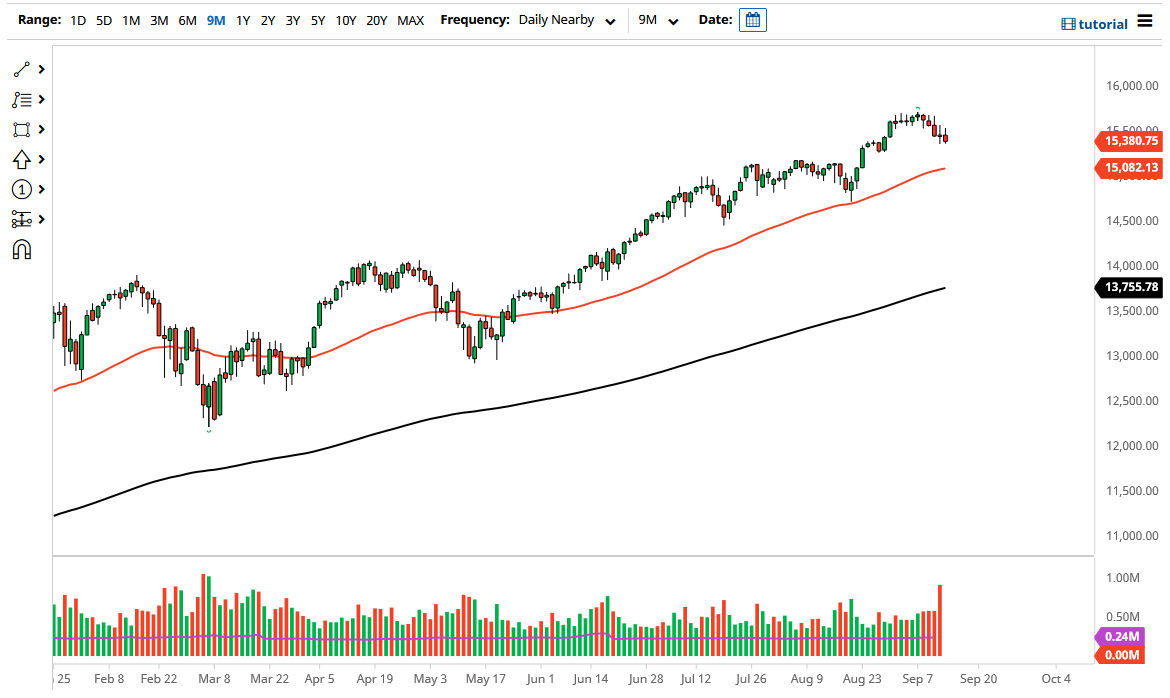

The NASDAQ 100 initially rallied a bit on Tuesday but gave back the gains again as we continue to see a little bit of negativity in this market. Ultimately, this is a market that looks as if it is trying to get down towards the 15,000 level, as we also have the 50-day EMA. This is a market that I think will continue to see a lot of interest in that area, especially since the 50-day EMA is so widely followed.

That being said, if the market does bounce a bit from this area I believe that the market will attract plenty of attention due to the fact that it is a well-known indicator for support. On the other hand, if we were to turn around and break above the top of the candlestick, then it is likely that the market could go much higher. This is a market that has been in a 45° angle channel for some time, and it is likely that we could continue to go higher. The 16,000 level is an area that I think a lot of people will be paying close attention to.

If we were to turn around and break down below the 15,000 level, then it is likely that the market will go looking towards the 14,500 level. That being said, if we do break down below the 50-day EMA and the 15,000 level, it is very likely that I would be a buyer of puts, as opposed to shorting this market. Furthermore, you need to pay close attention to interest rates, because if they continue to fall, that will help the NASDAQ 100. After all, this is an index that is highly correlated to the growth stocks, as the interest rate being offered as far as the “risk free rate” is concerned is minuscule. People start to look towards companies such as Amazon and Facebook to make money in that scenario, which drives this market higher overall. I do believe that this market will higher given enough time, but we may need to pull back a bit to find enough value to get people to put money to work.